Years ago we interviewed for a job at Microsoft. This was when Microsoft was on the rise. The guy interviewing us asked what books we had read. Before we could answer, he told us in a long and strange rant that he only read one book over and over again. It was a management book, we forget the name, but he raved about it and said reading other books was a complete waste of time. We wondered if the management book he’d read had suggested this approach to interviewing prospective employees. The interview was conducted in his office where the lights were turned down which added to the sinister atmosphere. We vaguely remember responding with some sort of defense of books and we feel as if we backed out of the room a bit like George Costanza did while George Steinbrenner ranted on and on.

We were reminded of this long-lost incident by the interview someone reposted with cryptocurrency FTX maestro Sam Bankman-Fried (we’re fairly certainly a novelist whose books have never been read by a certain Microsoft manager came up with that last name). “I’m very skeptical of books. I don’t want to say no book is ever worth reading, but I actually do believe something pretty close to that. I think if you wrote a book you ***ked up and it should have been a six-paragraph blog post.” We feel that if Bankman-Fried (we refuse to further sully this space with his first name) had read more books perhaps he would not be in the straits he is. As we work on our next book, we in less than six paragraphs tell you of The Coal Fifteen, discover which countries regulate cryptocurrencies and quantify China’s subsidies to their companies. It’s this week’s International Need to Know, the Raymond Carver of international information and data.

We’ll be busy preparing Amish potato dressing for Thanksgiving next week. Tagline for the recipe: “Creamy mashed potatoes combined with classic bread stuffing.” Now we’re worried a horde of readers will raid our house next Thursday. International Need to Know will return full of heartburn and holiday cheer on Thursday, December 1.

Without further ado, here’s what you need to know.

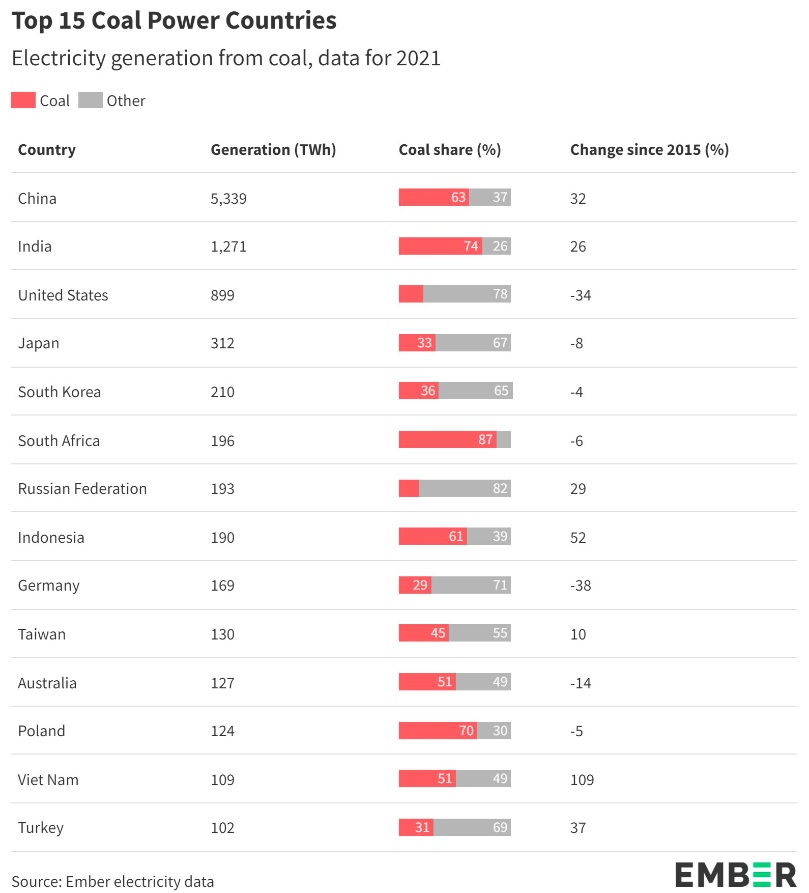

The Coal 15

The COP27 meetings are just finishing up. The world gathered together to talk about climate change without necessarily doing a lot about it. We have been following how and if developed countries will help developing countries in dealing with the impacts of climate change. As of this writing, the negotiations are ongoing. But, remember we are a relative climate change optimist: technology is advancing quickly in power generation and storage and renewable power is already cheaper than coal. But that doesn’t mean all is cleanly produced peaches and cream. Unfortunately, new coal generation capacity is still being built. As you can see in the chart below from Ember, China is by far the largest generator of electricity using coal. And it has increased 32 percent since 2015. Vietnam is a much smaller country than China so consequently has a smaller impact but it is still notable Vietnam saw the largest increase in generation of power through coal. That’s a sign of its strong economic growth during that period. We expect Vietnam’s usage of coal will decrease over the next seven years even if Vietnam’s economy continues to grow. We’d feel more confident in this if rich nations worked harder to make it happen.

Creeping Crypto

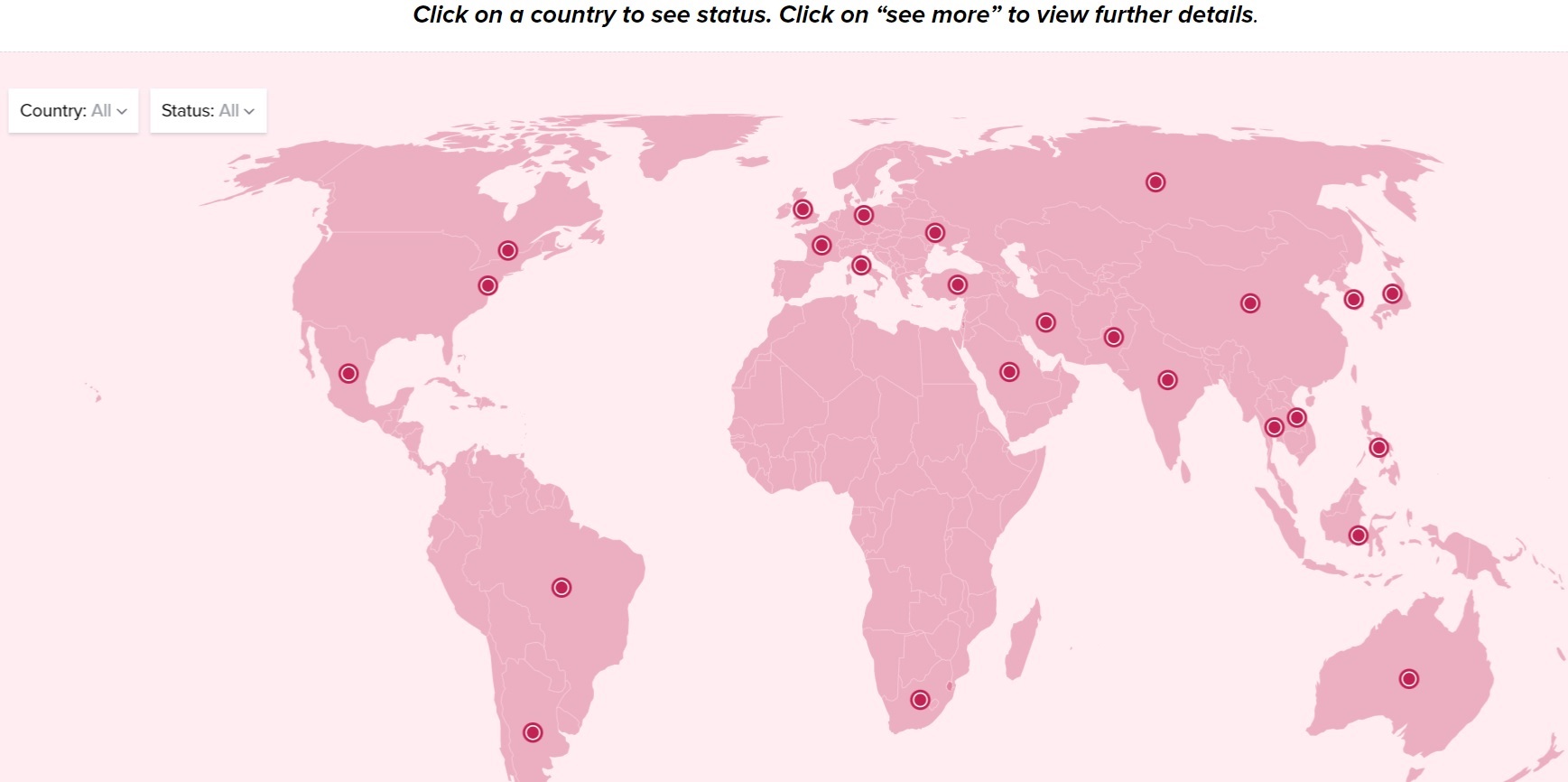

A number of years ago at a supply chain conference, a speaker was cavorting on about how the technology behind blockchains and cryptocurrencies were revolutionary. Like all such speakers on this topic they spoke in circular logic and we, without realizing it, criticized the person out loud. The person sitting next to us at our table heard us, smiled and agreed. It turned out, unlike us, he was in the technology business on the technology side. He patiently explained how the speaker was indeed full of, well, dogecoin waste. It confirmed our bias and so we never indulged in cryptocurrencies. However, many smart people we know have touted the potential of this technology so we don’t completely discount its potential even if we remain dubious. The collapse of FTX last week, and the apparent illegality of it all, got us to wondering about the state of regulations of the industry around the world. The Atlantic Council, it turns out, is tracking such regulations as you can see in the map below (click on it to explore more). The Atlantic Council tracks “25 countries—G20 member countries, in addition to countries with the highest rates of cryptocurrency adoption including Iran, Pakistan, Philippines, Thailand, Ukraine and Vietnam.” Nearly 90 percent of these countries are in the midst of changing the regulatory framework for cryptocurrencies. Only 44 percent of them have protections for consumers. We’re guessing, whether it’s a good idea or not, that these countries will be fast-tracking regulations of this sector.

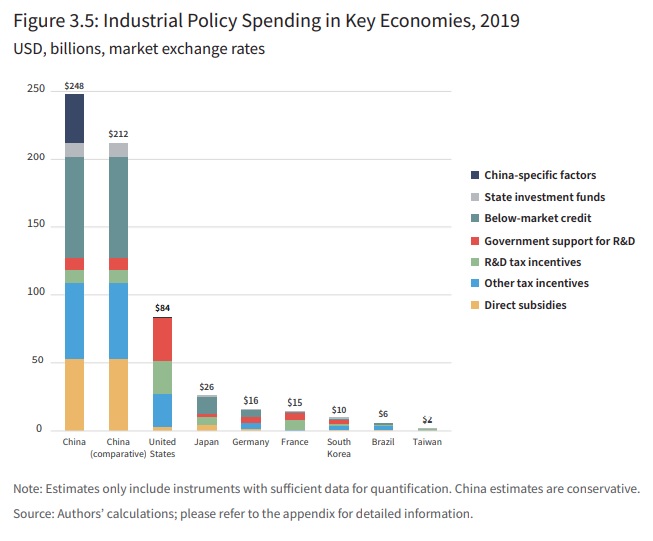

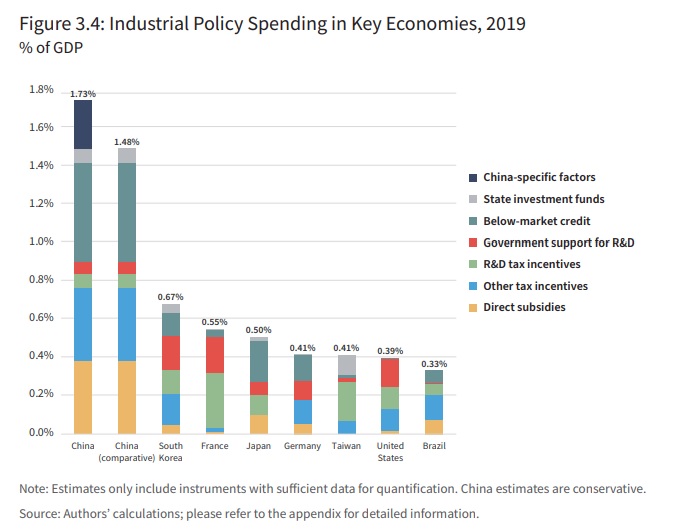

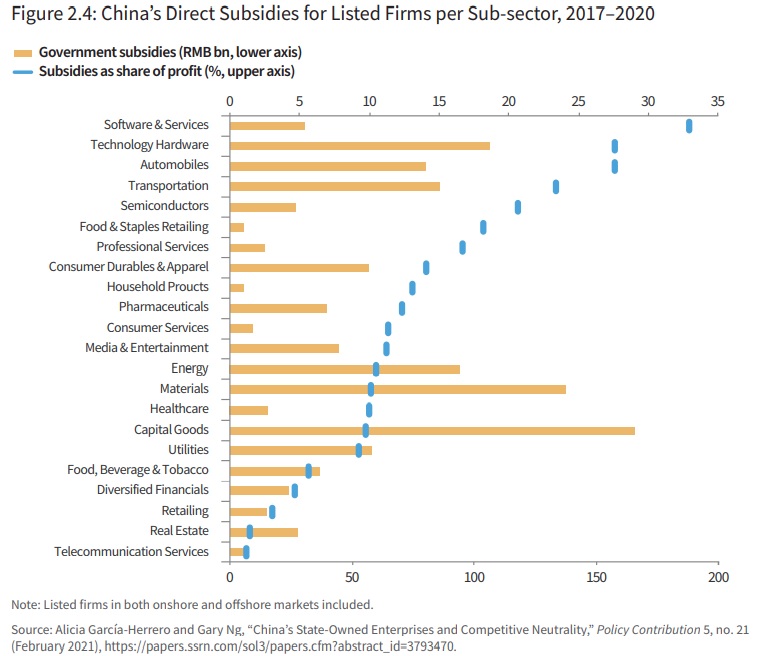

China Corner: China Subsidies

For decades people have been complaining that China doesn’t play fair economically. Its mercantilist policies have allowed them to become a manufacturing powerhouse goes the argument. Much of this mercantilism is China preventing outside companies succeeding in certain Chinese industry sectors. There’s a reason companies like Amazon, Google and others are not successful in China and it has nothing to do with their not knowing how to do business in China: China closes what it considers key areas to outside companies. Increasingly what are considered key industries is expanding. But, China also provides subsidies for its companies. The Center for Strategic and International Studies (CSIS) recently tried to quantify China’s subsidies. They found they are large both in absolute terms and in comparison to subsidies provided by other countries to their own companies. As you see in the first chart from CSIS below, China spends more than twice as much as any other country helping its companies. And as you see in the second chart below, China also spends as a percentage of its GDP more than twice as much as any other country. As CSIS puts it, “Even when utilizing a conservative methodology, China is an outlier. It spends far more on supporting its industries than any other economy in the study.” China’s three main vehicles for doing this, as you see in the third chart below (a rare three chart story!) are direct subsidies, tax incentives and below-market credit. We expect China to continue to do so for industries it considers strategic. But, with a now slower economy and debt issues, it will be interesting to see if they get the same economic return as before.