As our mind and body wander through this crazy little orbiting rock, we can’t help but return to a recurring theme here at INTN: change. We see it nearly everywhere we go and learn about it in much of what we read. There are, of course, the rapid advancements in large language models, applications of which we are increasingly tapping into. And our old favorite, self driving cars, are again making rapid advancements with Waymo increasing service in both San Francisco and Phoenix and a host of Chinese companies working feverishly to build their own platforms. Major medical advancements occur weekly. The clean energy movement is transforming our world faster than people realize with now 40 percent of electricity in Texas generated from renewables, most of which is wind and solar.

We’re more convinced than ever that the 2030s will be a very different place than what we inhabit today. Even the weather here in Seattle has changed with spring finally bursting, bringing sun, warmth and pollen. So as we went on our evening bike ride the other day we cued up “songs about change” on Spotify. Strangely most of the songs were about happiness, everything from Don’t Worry, Be Happy by Bobby McFerrin to Three Little Birds by Bob Marley. The playlist was a sonic Zoloft as if Spotify’s algorithm is worried we can’t handle the truth of change. Worse, the Spotify music world is the only place where there is no change. Spotify’s playlist was a catalog of hits from the past with neither a deep cut nor a new gem to be found. Similarly, when we gaze at the summer movie list we see a parade of sequels and remakes. What will it take to transform popular art and culture?

So as we await AI to somehow transform our cultural offerings we learn about fixing corrupted corruption rankings, who has the largest homes in the world and what’s going on with China’s exports. It’s this week’s International Need to Know, like Nikola Jokic, assisting on international data and making shots on international information.

Without further ado, here’s what you need to know.

Fixing Corrupted Corruption Rankings

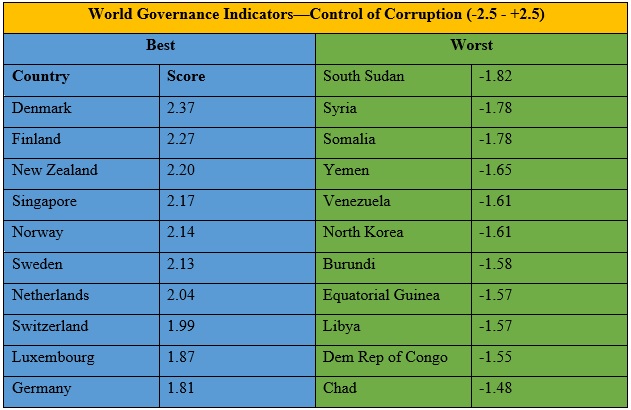

You may remember that a few years ago the World Bank discontinued its Doing Business analysis after it was revealed countries such as China and Saudi Arabia were bribing the World Bank officials to pump up their rankings. Whoops. Doing Business attempted to assess the ease of doing business in a country, including looking at corruption. The World Bank is getting ready to launch a replacement called Business Ready. We hope it improves upon Doing Business and is less corruptible. In recent years we have examined the World Bank’s Worldwide Governance Indicators. They are not perfect either but provide some data on government effectiveness, rule of law and control of corruption. As you can see in the table below, Denmark has the best control on corruption in the world, followed by Finland, New Zealand and Singapore. The countries with the worst control are South Sudan, Syria and Somalia (“S” countries are corrupt?). But take these rankings with a grain of salt. As Yuen Yuen Ang’s research shows, there’s a lot of work still to be done in understanding corruption in countries. As Ang points out, the U.S. and other developed countries have their own corruption problems though we often don’t call it corruption.

Home Size

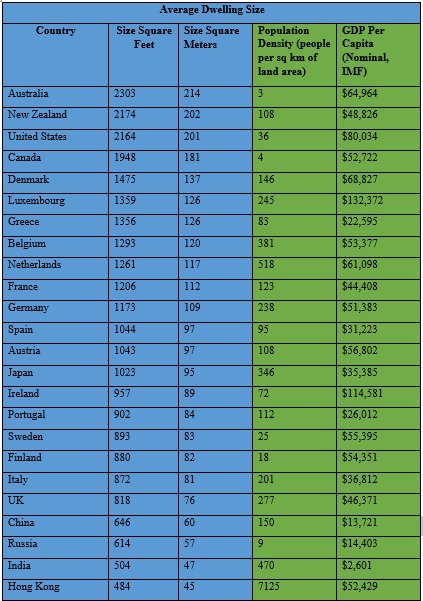

Ever wonder who lives in the largest homes? And we don’t mean just the Roys, but which countries populations are prone to living in larger abodes? The earnest people at Shrink That Footprint (STF) provide a very partial answer of some selected countries. As you can see in the chart below, Australians live in the largest homes with an average size of 214 square meters, followed by New Zealand, the U.S. and Canada. Of course, three of these four countries are much larger geographically than most other countries so have more room for bigger homes. And in New Zealand’s case, they have a relatively small population compared to their geographic size. China and India are big countries geographically but also not nearly as wealthy as the top four. And, of course, they are more populous. We bet, if we took the time, we could predict home size of countries based on available geographic space and GDP per capita. In fact if you look at that data in the fourth and fifth columns below, there are only a few outliers which are somewhat easily explained. Of course, STF’s point is that it is better for the environment if we live in smaller homes and shrink our carbon footprints. That’s true in a static sense. Smarter would be to create clean energy so people can live in the type of homes they want: large, small or otherwise.

China Corner: China’s Complicated Exports/Imports

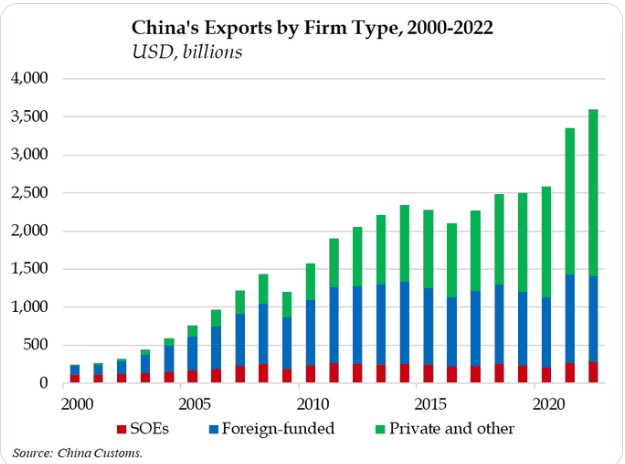

China is complicated. All big entities are and China is large, geographically and population-wise (though now shrinking in the latter). In April, China’s exports increased again. Some analysts asked how since China is giving more prominence to state owned companies (SOE) which in their estimation should not be so successful. Others wonder why China’s imports fell in April and have generally decreased in recent years. On exporting, Gerard DiPippo of CSIS points out that SOES are not the ones exporting. Those are generally private companies (albeit with increasing CCP scrutiny). As you see in his chart below, the exporting companies are either private Chinese firms or foreign-funded firms. SOEs are a tiny fraction of exporters. DiPippo says that’s because, they are generally inefficient. That’s true but it’s also true that these other “private” companies, at least in “strategic” industries such as batteries, also receive government subsidies as we’ve pointed out before. And SOEs play a role in building industries whose private companies then go on to export. As we said, it’s complicated. Imports are down for a variety of reasons, including increasingly Chinese companies are sourcing components domestically and because of weak consumer demand. More on that sometime soon.