We gather there continues to be robust argument on the merits of small towns vs cities, including over a recent song touting the virtues of the former. We cannot vouch for the song nor the songwriter but despite our living in a city we recently were saved from trouble by the virtues of small towns. Although our novel that we expect to have completed before you raise a glass of champagne in honor of the arrival of 2024 begins with the words, “If I hadn’t answered the phone the world wouldn’t have come to an end” we must admit our troubles this week came via text. The person tending to our Mom’s yard in Bellingham informed us there appeared to be a pipe leaking. And indeed the large puddle of water in the yard she included in her text was good evidence.

We, of course, were nowhere near Bellingham at the time. But a friend of ours lives there and being a true small town hero, he went to inspect the problem. And at the same time we called the Bellingham water department, who believe it or not, have a cell phone listed on its website should you need after hours help. We called and immediately got through to a human being, no phone tree, AI or any other barriers to doing so. The person could not have been more helpful and responsive and within a half hour they had turned the water off to the house. We shudder to think what would have happened if we needed to call the Seattle water department in such circumstances. Perhaps we would be writing this missive with scuba gear on. The immediate crisis averted, we took to solving the longer term problem, which our friend helped by finding a few companies who could fix it. One of the companies came out and said they could do the repair that day. And so they almost immediately began digging. And before the clock ticked five, had indeed fixed the pipe, turned the water back on and a few days later sent us a bill for an astonishingly small amount. In a city, it may have taken until we toasted 2024 to get the work done and we would need to take out a second mortgage to pay for it.

So although we are very fond of cities, we also toast small towns while examining Asia cooperation, noting the strength of large U.S. global companies and adding nuance to the “China’s economy is in trouble” discussion. It’s this week’s International Need to Know, the John Mellencamp of international information, the Lou Reed of global data.

Without further ado, here’s what you need to know.

Asian Collaboration

The United States, like each of us writing and reading this missive, thinks of itself as the main character in a long novel. But the world is actually a much more complicated narrative; in fact not a narrative at all but a chaotic fractal as we’ve been trying to explain for many years here in this space. So even as Biden heads to Vietnam soon to sign a variety of economic and security agreements, it’s important to note that southeast Asia is cooperating on its own as well. We do not live in a unipolar world. As just one of many examples, the Philippines and Vietnam announced that they are signing a maritime cooperation agreement mainly to deal with China’s threat to the South China Sea. President Marcos said, “it will be a very, very important part of our relationship and it will bring an element of stability to the problems that we are seeing now in the South China Sea.” This agreement follows up on a Code of Conduct the Philippines and Vietnam developed for the South China Sea a couple years ago. For those keeping score at home, China basically lays claim to the entire South China Sea, including territory thousands of miles from its border. This is a little bit like if we said we control Chicago from the worldwide INTN headquarters in Seattle, or that we invented deep dish pizza. Yes, we all have our own strange narratives.

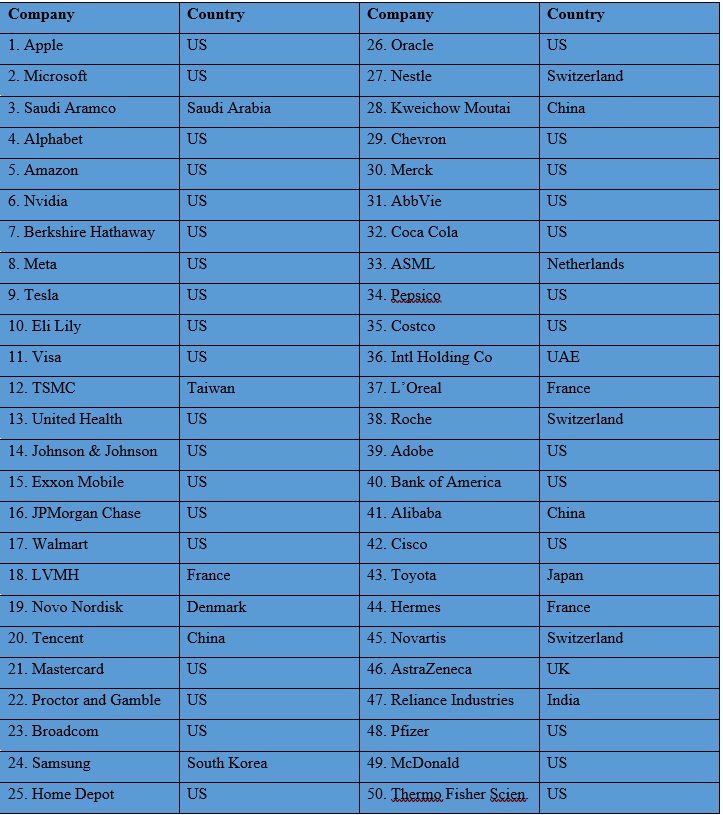

US Large Companies Dominate

So right after complaining about America too often gazing at itself in admiration and disgust, depending on who looks in the mirror, we pause to note how influential U.S. companies continue to be. Let’s take market capitalization as one way of measuring this. Nine of the top ten companies with the largest market capitalizations in the world are U.S.-headquartered. Only Saudi Arabia’s oil behemoth, Aramco, cracks the top ten, coming in at number three. Almost two-thirds of the top 50 are U.S. companies. China once had many companies in the top ten but its tech crackdown changed that. Only China’s Tencent cracks the top twenty, and barely. In fact, Tencent’s market capitalization is lower than semiconductor champion, TSMC, out of Taiwan, which China likes to say is part of its country. Still, China has the second most number of companies in the top 50 with five. Note that nearly all of the U.S. companies in the top 50 are global in nature. So yes American companies still dominate and are influential but they wouldn’t be if it weren’t for globalization. Much of these companies’ profits, innovation and growth are due to international markets and supply chains. So their influence is not necessarily only because of the United States. Look at that in your mirror.

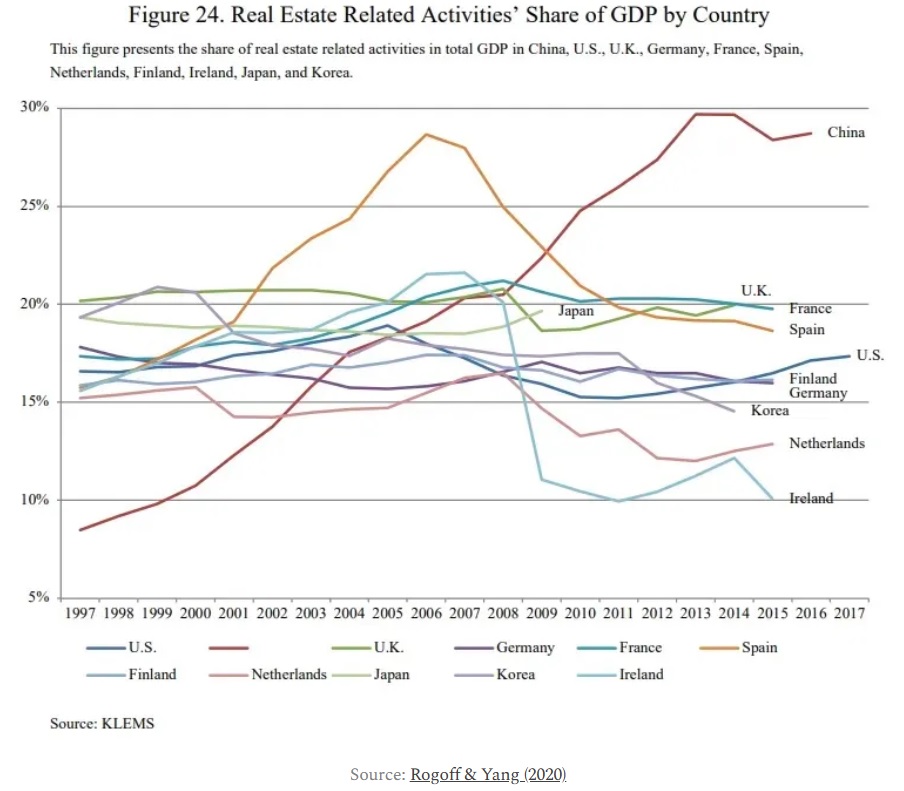

China Corner: Economy Slowing Not Collapsing

All of a sudden all at once, everyone is convinced China’s economy is doomed. You probably expect us, who have been writing and stating for years that China’s economy will no longer experience high growth, to confirm this. But we pause to add a little nuance to the situation. First, there’s a difference between saying China’s economy is collapsing (it isn’t) and it is slowing* considerably and will experience slow economic growth going forward. Second, one of the reasons its economy has slowed is because of its reckoning with an overreliance on real estate. A few years ago China proactively started working to reduce this overreliance and that has inevitably led to even slower economic growth and financial challenges. But it had to be done. The pain was coming sooner or later (the pain isn’t over). China also has large debt issues at the local and provincial level, as well as in the financial sector. China, at least so far, does not appear to be addressing these as forthrightly as it could and many will argue it is not addressing the debt issue smartly. Third, for geostrategic reasons, China is putting its resources and efforts into supporting what it perceives as strategic industries such as AI, robotics and others. China’s government is not concentrating on trying to help people even though household income as a percent of GDP is still remarkably low. Xi is preeminently concerned about his and the CCP perpetually staying in power. But he also wants to make China the giant of the world stage. We guess he’d be more successful in his goals if he helped Chinese more and worried less about geostrategic dominance. So China’s economy has slowed and it will likely grow no faster than the U.S. economy going forward. But China’s economy is not collapsing, at least not yet, and probably won’t. The big question is what does a slow economy mean for the prospect of China someday liberalizing? Few are asking.

*This slow down started a few years ago. People are paying more attention now but the economic challenges are not new