We’ve been fortunate to travel to cities all over the world. We’ve seen the pyramids outside of Cairo, gazed upon the Sistine Chapel, watched the natural wonder of Table Mountain in Cape Town and squinted at the amazing miniature art of the National Museum in Taipei, to mention just a few. But as Bob Dylan wrote, “There are a lot of places I like, but I like New Orleans better.” On our first trip to New Orleans with our wife, but not our first trip to New Orleans, we were walking towards Frenchmen’s Street and a guy walked by us with a sousaphone. Only in New Orleans. Unfortunately, because of the pandemic, we haven’t been there in over a year. We haven’t been anywhere. The one person happy about this is our cat, Putter. Nobody has been more pleased by, and taken advantage of, our staying home, than he. We like to quantify things and wish we had tracked in an Excel spreadsheet the number of times he has interrupted our Zoom meetings over the last twelve months, climbing onto our shoulder and rubbing his head against ours. We guess it’s close to 40 percent of our meetings. You may think we have an oversized admiration for this feline but it is not just us. Putter had his check-up with the cat cardiologist this week (yes, such a thing exists) and she came out to the parking lot to tell us she was so excited to see him on her schedule the night before. She loves Putter. And Putter, seemingly, loves the world back, only wanting a lap and a pet, and for someone, anyone, to pay him attention, to help him take it easy. He is, perhaps, the New Orleans of pets. As he clings to our shoulder now, looking a bit like a koala bear hanging onto a tree, we see the sunshine of climate change solutions, worry about the world’s middle class, and tug at our t-shirt’s cotton uncomfortably. It’s this week’s International Need to Know, vying to be the Tina Turner of international information, the Proud Mary of international data.

Just a late March day in NOLA with musicians hanging out playing in the neighborhood, including world famous Trombone Shorty. Only in New Orleans

We may not be able to go anywhere since we are not yet vaccinated but we are taking a spring break next week. INTN will return on April 15. In the meantime, don’t look for Putter and I on Zoom.

Without further ado, here’s what you need to know.

We’re Almost Walking on Sunshine

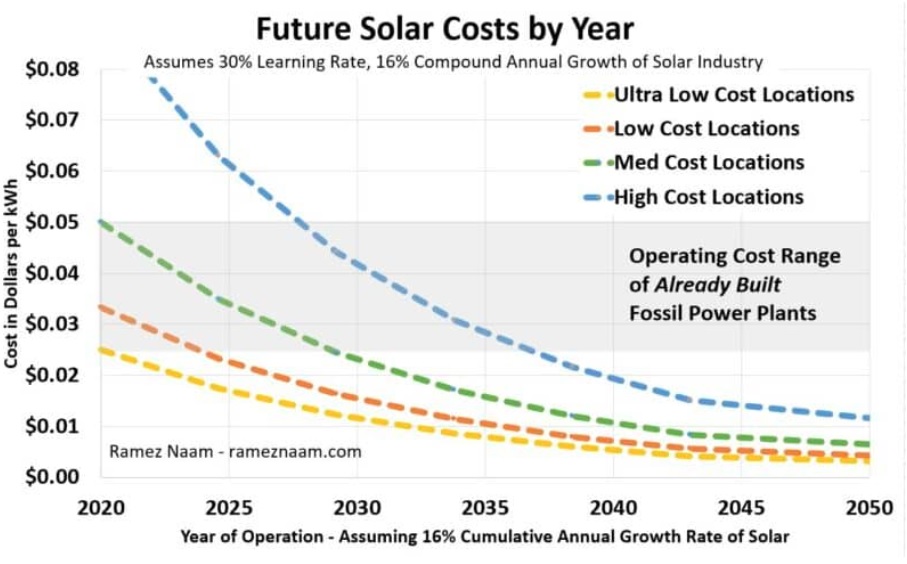

For reasons we will not yet reveal, we’ve been poring over climate change data recently, as well as learning about people’s attitudes on the issue. Like a Seattle spring, there are clouds of pessimism aplenty despite pockets of sunshiny data promising summer is coming. What too many still don’t recognize is the enormous progress in renewable power energy generation and storage in recent years. The levelized costs of energy generation* dropped much more steeply for solar and wind than experts predicted so that now solar is less expensive than gas and coal in many parts of the globe. As former Micrsoftie (softer? softite?) and now clean energy maven Ramez Naam has documented, the International Energy Agency consistently underestimates the drop in the cost of solar power. Naam created his own projections for the price of solar in high cost locations all the way to low cost locations. Note that in less than a decade, even the price in high cost locations is competitive with “already built fossil power plants.” Reflect on the fact that Naam’s past projections of cost decreases have also been too pessimistic. At the same time of rapid advances in solar energy generation we’re also seeing progress in energy storage technology. We are not yet in the land of Katrina and the Waves but we’re walking there more quickly than people realize.

* The levelized cost of energy, or levelized cost of electricity, is a measure of the average net present cost of electricity generation for a generating plant over its lifetime.

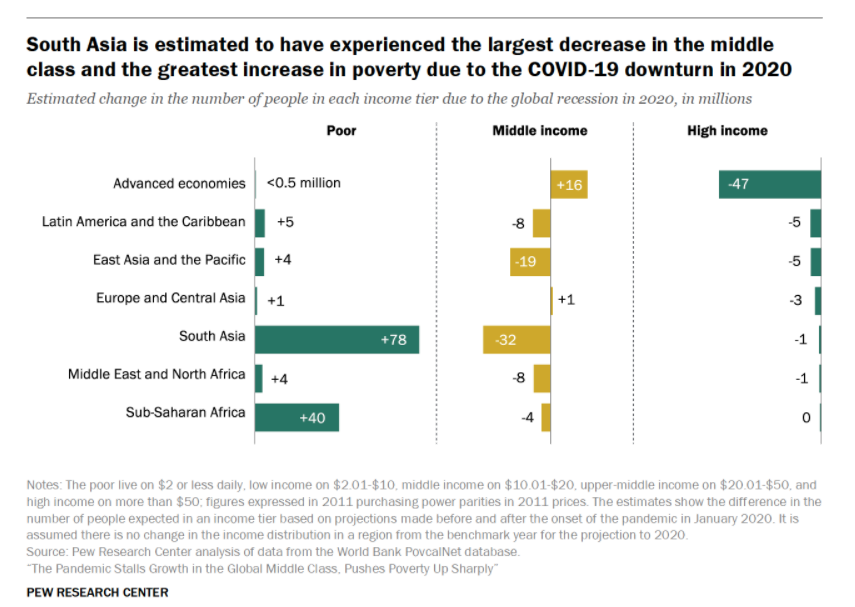

The Middle Doesn’t Hold

We are indeed an “empirical bastard” as Lou Dobbs once called us. But there are real people behind the numbers. For example, last year the global economy contracted by 4.3%. That negative economic growth has real consequences: “A new Pew Research Center analysis finds that the global middle class encompassed 54 million fewer people in 2020 than the number projected prior to the onset of the pandemic. Meanwhile, the number of poor is estimated to have been 131 million higher because of the recession.” South Asia and East Asia were the main locations where the middle class was hardest hit, according to the study. The largest rise in poverty during the 2020 pandemic year was in sub-Saharan Africa. In advanced economies, the size of the middle class managed to increase last year. This is all the more reason for these advanced economies to increase their efforts to vaccinate around the world. The U.S. vaccine supply will soon outstrip demand. It needs to reallocate that supply quickly to other countries.

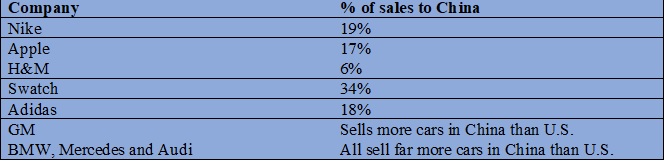

China Corner: King Cotton

If you’re like me, perhaps your t-shirt is a little uncomfortable right now. No, it’s not too tight from adding a few pandemic pounds, but it claws at the conscience. That’s because there’s a good chance your shirt is made from cotton produced by the forced labor of Uyghurs in Xinjiang, China. You probably saw that H&M made a statement that they would ensure none of their clothing uses such cotton and that quickly they were castigated in China, and banished from E-commerce sites and Apple maps, and otherwise became persona non grata in the Chinese market. Fairly quickly, H&M took the statement off their website. There are some policy and political wags calling for complete decoupling from China. The twin challenges to doing so is China is intertwined with the global economy and their market is so large. Below is a sampling of the percentage of sales from China for some large U.S. and European companies. For Nike, it’s 19 percent, for Apple it’s 17 percent. For German automakers it’s nearly half. It was hard enough to mount a worldwide campaign to have businesses disinvest from little South Africa back in the Apartheid day. It seems nigh impossible to do it for a market as large as China’s. How many Europeans, Americans, Canadians, Japanese and others will boycott these companies if they continue to use slave labor from China? Will the lost revenue from such boycotts be more than if they lose access to the Chinese market? During Apartheid, many Hollywood, musical and sports stars helped encourage boycotts of companies in South Africa. But what if those stars themselves now make a considerable amount of money from China? China is committing, at the least, crimes against humanity in Xinjiang, and in our estimation genocide. What to do about it that will be effective is complicated. Next issue we’ll discuss how China’s dual circulation policy may play into this complex calculus. The math may not be fun.