I spend most of my day either charging the army of devices I use or looking for the correct charger* for each device (the rest of the day is spent searching for just the right word to use in a sentence for you, dear reader). We bring this up not merely as a rich world complaint (Ukrainians and Uyghurs have just launched missiles at the INTN headquarters in retaliation) but rather to point out progress is not moving fast enough for our taste and we hope for yours as well. Over a decade ago we read about scientists working on technology that would allow us to charge our devices using our kinetic energy produced while walking, running, doing chores or even typing on a computer. But today what has come of that research? Nada. Lots of people think things are changing too fast—the New Amish we like to call them. Our fear is there is not enough change.

When we were a kid we would have thought our world would look much different, far stranger, perhaps even hard to recognize by 2023. There has been lots of geopolitical change, some for the good and some for the bad, but technological and cultural progress seems way too slow. We need more change, faster. I want the Y generation, or whatever they are called, to live in a world I’d barely recognize. Folks from various parts of the political spectrum are tackling this lack of progress from various perspectives, including Derek Thompson, Ezra Klein, Tyler Cowen and Patrick Collison. In the meantime, as we look for the iPad charger so we can complete this sentence we bring you predictions for the new year (and what we hope happens), why we’re not as worried about lithium as many are and whether China’s reign as the king of manufacturing is coming to an end. It’s this week’s International Need to Know, resolving to bring you the most important and interesting international information and data throughout the year.

*The EU is mandating that all devices use the same charging port so soon this life annoyance will be gone. This is, of course, the most important measure the EU has passed in the last ten years and will likely convince Britain to exit Brexit.

Without further ado, here’s what you need to know.

What Will/Should Happen

We see people making predictions this time of year even though many/most things are impossible to predict. Keeping this in mind, we will play a little game of what will/what should happen in a few select crucial areas*

China’s Economy

What Will Happen: As China gets past the current catastrophic Covid wave, some time in late January or February it will start to experience bounce back growth. This will fool analysts into thinking China is back on the fast GDP growth train and provide duplicitous multinational financial firms a chance to further con people into giving them money. But after the Covid economic rebound, China’s GDP will grow at about the same rate as the U.S. What should happen: China should help consumers, create social safety nets, radically reform the hukou system and liberalize politically.

Russia’s Invasion of Ukraine

What will happen: The bloodiest war of the century will continue. What Don’t We Know: Will Ukraine continue to take back its land and will its allies have the stamina to continue helping Ukraine? What should happen: Russia should give back territory, compensate Ukraine and send Putin to face war crime charges (the West should help Russia once it has done these things…and yes, none of this will happen).

AI

What will happen: The chattering class will point out all the ways GPT-3 comes up short. GPT-4 will be released before the end of the year and be a vast improvement but like anything will have its flaws. Those will be pointed out endlessly by the short-sighted on Twitter. But before the end of the year AI will already be transforming how we work in profound and substantive ways. What should happen: Preparing for a transformed world with policies and education*This post will self-destruct before December 31st, 2023 so nobody can point out we were completely wrong.

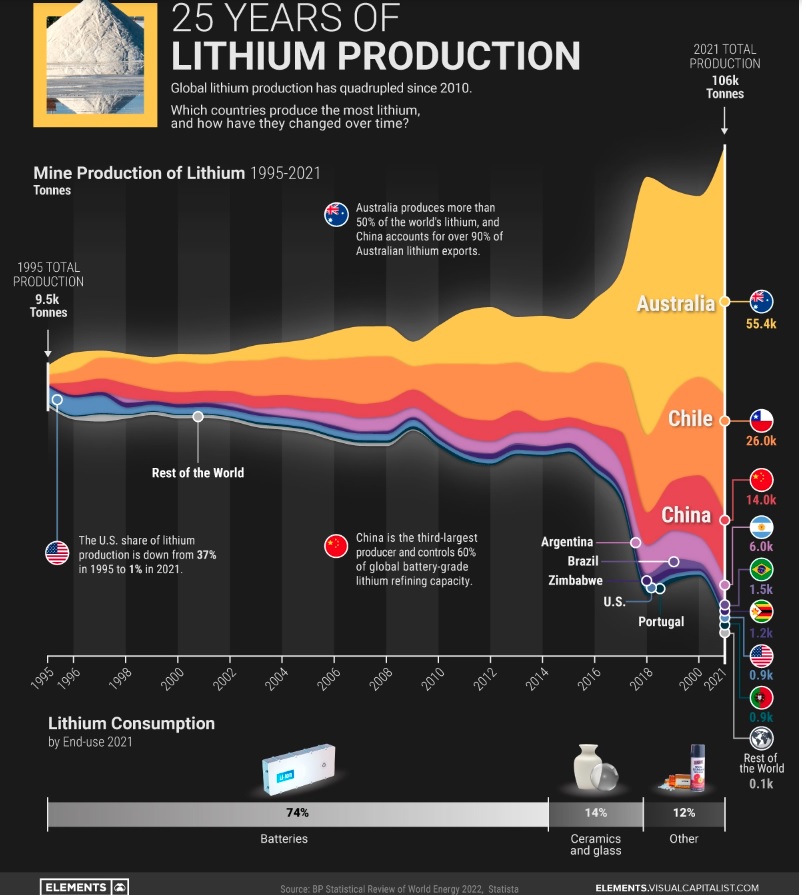

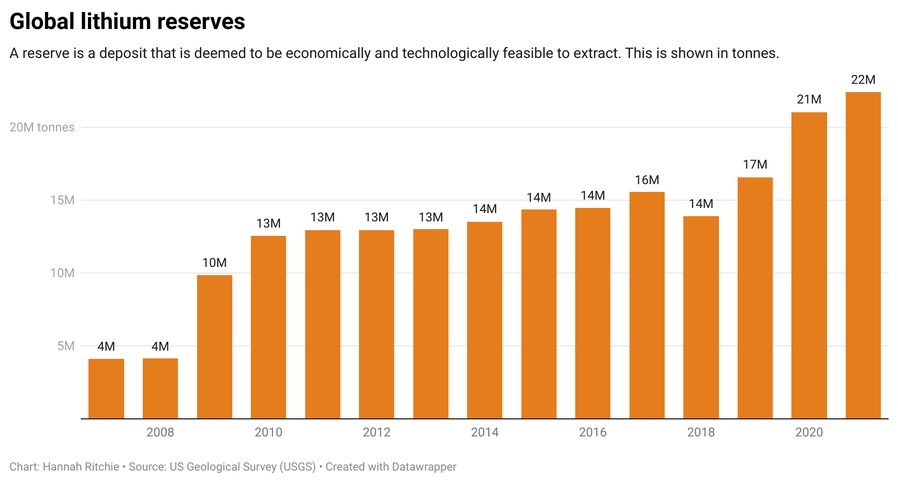

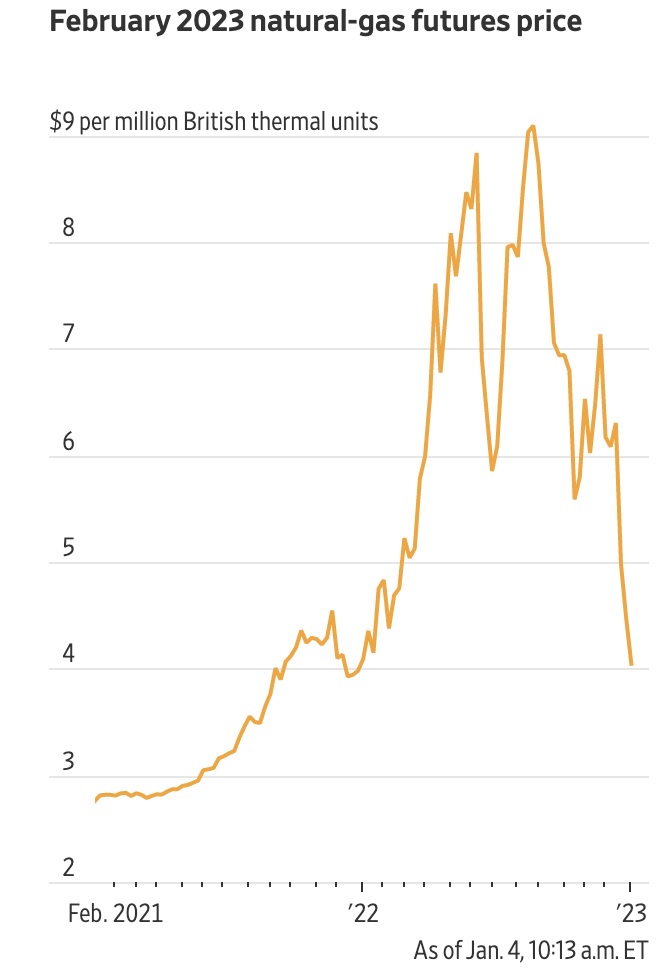

Lithium Schmithium

Necessity, we have been told, is the mother of invention. There are certainly a lot of Moms out there, which is mostly what the news concentrates on, but there are also a lot of sons and daughters. We thought of this when looking at the chart below of who produces lithium. The chart shows lithium is mostly produced by a few countries. And yet who those countries are have changed a lot over the years. But, of course, people are very concerned a lack of lithium will slow down the conversion to electric cars and harm our efforts to address climate change. We bet it won’t. Already, the Chinese battery company CATL has touted a new battery technology that does not require lithium though there are lots of skeptics. And we bet we’ll figure out ways to find more lithium or recycle it (see second graph below on increase in lithium reserves). It all reminds us of when everyone said Europe was in trouble this winter because of its dependency on Russian fossil fuels. Folks were predicting high out of control prices this winter and a catastrophic time for Europeans. And yet, look at the third graph below of gas prices. No catastrophe to be found. There are a lot of mothers out there and thank goodness for them, and for all the children they give us.

China Corner:

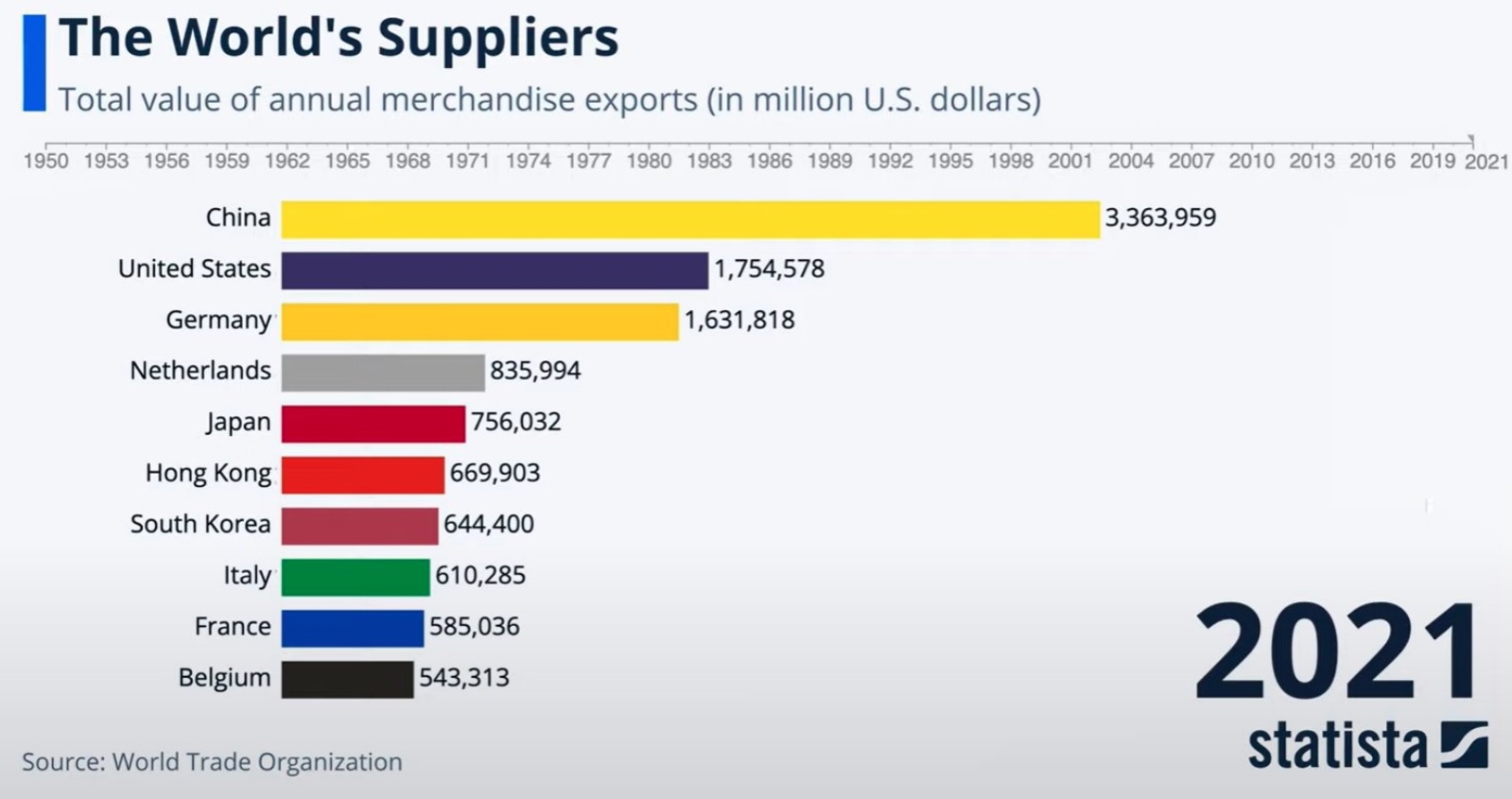

Manufacturing King to Prince?

China is by far the largest manufacturer in the world and is king of the supply chain. The first graph below shows just how dominant China is in exporting. Its merchandise exports are larger than the U.S. and Germany combined, the second and third largest exporters. As we pointed out last year in speeches, and occasionally in this space, that is changing. Apple now has an outside of China option for all of its products. It makes Macs, iPads and everything else both in and outside of China now. That’s a big and important hedge. European companies are increasingly doing something similar. German car companies have profited handsomely from the Chinese market but are now facing increasing competition from Chinese electric car exports into Europe. China’s automobile manufacturing success is due partly to its protectionist policies for its EV market. The U.S. is now doing something similar. The acceleration of diversifying supply chains out of China was due to the damage from China’s zero covid policy. Now that the policy has been smashed like a hammer coming down on a vial in a lab, will companies remember the lesson of China’s unpredictable polices and its effect on their business or will they soon re-enter China? We expect global supply chains are changing permanently out of China.