On our walks, when we ride our bike, even while driving, we are in search of color. Specifically for our house which we hope to repaint next summer. But what color? What hue? And so we pay attention to houses as we traipse the grey garden of Seattle. But finding color is exceedingly difficult. One of our long-time complaints is that in a city whose weather is gray nine months of the year, nearly all the houses and buildings are gray. Sometimes dark gray, sometimes pale, other times a particularly dirty shade of dust. In our neighborhood perhaps three-quarters of the homes are one shade or another of the same color as the clouds above.

Office buildings and high rises are similarly drab—not only in color but shape too. Box after box, nary a curve or angle among them, all the color of cement or made of glass without a tinge of any spectrum of the rainbow. Why the allergy to color? We do not understand it. Once upon a time whenever we walked by a house with a garish paint covering its exterior we’d turn up our nose. But now we view even those stark neon colors as better than the standard issue Soviet gray that we all use to cover our homes and buildings. We intend to fight the tyranny of the drab—except that the International Need to Know spouse, born and bred in Seattle—is likely to favor the city’s favorite tint. As we go to battle carrying a bright palette, we paint a complicated view of the pessimism-optimism battle, ask “then what?” regarding the muddy-colored future of Gaza and examine China’s attempts to white-wash the garish red debt of its local governments. It’s this week’s International Need to Know, the rainbow of international information, the prism of global data.

We’ve been going to Wilco concerts with our friends Mike and Pete almost as long as Wilco’s been playing (and talking about the band with our other friend, Mike–Mike friends can’t be beat). We saw Wilco again Tuesday night and as usual they were extraordinary. Around the 3 minute mark of Bird Without A Tail/Base of My Skull, we were witness to one of the more profound guitar conversations we’ve ever seen live. Below is from a different concert containing a similar great sonic discussion.

Without further ado, here’s what you need to know.

The Case for Optimism…And Pessimism

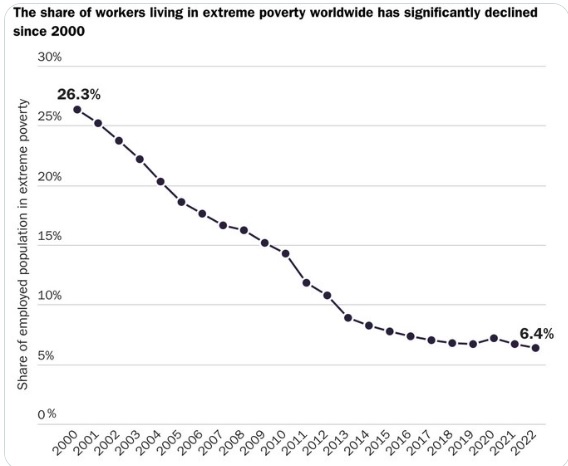

Last week, we discussed some worrying trends in our world, the case for pessimism, so to speak. But we should remember, people are perpetually pessimistic despite bundles of evidence they shouldn’t be. As part of its continuing “Defending Globalization” series, Johan Norberg of the Cato Institute notes that in 2002, “Nobel laureate Joseph Stiglitz claimed that ‘globalization has become a race to the bottom, where corporations are the only winners and the rest of society, in both the developed and developing worlds, is the loser.’” And yet, as Norberg points out, the opposite happened. The share of workers in extreme poverty fell precipitously as you can see in the chart below by Norberg. Since 2000 there has been a reduction in worker-related injuries around the world. As countries got richer, they improved their ecological problems. As we noted last week, global poverty fell, including in the last two years after the pandemic. The reason for pessimism is that so many people view globalization as a problem and would like to end it. Fortunately, they haven’t, yet. Trade is not increasing but is still at a high level, supply chains are diversifying out of China but that’s just a change not an end to globalization. Financial flows continue. People still move to other countries (the great immigrant competition is coming). But globalization’s brand has taken hits since at least the Seattle WTO riots in 1999. And yet, globalization has led to huge improvements in the world. The case for pessimism is that globalization ends. The case for optimism is globalization chugs on.

Another case for optimism is that democracy works. Despite all the authoritarian efforts by the badly named ruling Law and Justice Party to ensure they could never lose power, the good people of Poland voted them out. There are many barriers to the winners exercising power they have earned through the ballot, but Poland’s election is a hopeful sign in a week full of pessimistic geopolitical news.

Then What?

Last week, after a brief comment on Hamas war crimes and how invading Gaza might be more difficult than people expect, someone sent us an article by David French comparing Israel’s military campaign in Gaza to how the U.S. and Iraq took down ISIS. Whether French’s comparison is how the Israeli military action in Gaza plays out or not, our response was “then what?” Let’s say Israel successfully eliminates Hamas as an active force in Palestinian and Israeli life. What is Israel’s strategy then? For Gaza? For the West Bank? For Palestinians in general? Even admitting that Palestinian leadership has been corrupt and counter-productive in dozens of ways (as have many Israeli leaders), that still leaves 5 million people wanting to live their lives, as we all do, with life, liberty and the pursuit of happiness. When we worked for a member of Congress many, many years ago, we remember discussing the Israel-Palestine issue with a staffer on the Foreign Affairs Committee. She said it was an issue that would never be solved. We were young and even more optimistic at the time and argued the point with her. But thirty years later she certainly has been proven right more than we have. But never is a long time. The only way to solve the issue is for Israelis and Palestinians to answer the question, “then what?”

For a depressing but insightful analysis of these incredibly challenging issues, see this from Isaac Saul of Tangle News.

China Corner: Robbing Peter To Pay Paul

For quite some time, we’ve been saying if there’s any tension in China against Xi Jinping it will occur at the local and provincial level. This is partly because that is where much of the economic challenges are taking place. These governments derive much of their revenue from land sales, which was great when the property market was doing well. But now that the property market continues to struggle, so too are the coffers of local governments. That’s where lots of China’s debt exists. So it’s not surprising, as Reuter’s reports, that “China has told state-owned banks to roll over existing local government debt with longer-term loans at lower interest rates.” China’s government has also decreed that “Loans that were due in 2024 or before will be categorized as ‘normal’ instead of non-performing if they were overdue, and that won’t affect banks’ performance evaluations…” Renaming a problem as not a problem seems, er, problematic. And on state-owned banks taking over local government debt, these banks are already under capitalized. As Michael Pettis notes, “This form of restructuring, of course, does not resolve the local-government bad debt problem. All it does is transfer the liquidity risk to local banks while forcing them to absorb part of the debt-servicing costs, in the form of lower revenues.” At some point, China will need to institute major reforms on government financing, social safety nets and other structures. If they don’t, the CCP’s perpetual power machine will run into trouble.