Here in Seattle, the worldwide headquarters of International Need to Know, we are soon to enter what the locals call the Big Dark. That is, the late fall/winter/early spring when not only are skies full of clouds but because of our location in the north, the sun goes down before 5 pm and dawn rises like a lazy teenager. Alaskans scoff at our petty troubles but we admit to increasingly disdaining this time of year. It is one of the reasons we look forward to when we’ll be living in New Orleans in the winter months during a happy, care free retirement. It will be warmer, and somewhat lighter in the Crescent City, and of course the music, food and culture will be impossible to beat (a backbeat, of course).

At dinner this week with a friend in from NYC who is originally from here and may move back, we noted it is at least warmer here in winter time than in the Big Apple. But he and the others around the table rebutted this weak argument. The temperature might be higher in Seattle but the pervasive damp makes it feel colder. Walking back to our car after dinner in the drizzle we shivered in recognition. But even in the rain, even in the dark, there is plenty of light out there. For one, it was a wonderful dinner with old friends. For two, we have much to look forward to here in Seattle, and in distant places we plan to travel to in the coming months. And the world, as dark it may sometimes seem, continues to dazzle in all its complicated, mixed-up ways such as peak oil arriving early, global supply chains diversifying despite claims to the contrary, and China rapidly building up its military. It’s this week’s International Need to Know, where the sun never goes down on international information and data.

Without further ado, here’s what you need to know.

Peak Oil

September was the hottest month on record and it appears October is giving Earth Wind and Fire’s favorite month a run for its money. But there continues to be encouraging news on the climate change front (a warm front presumably). The environmental think tank Ember reports that “Half of the world’s economies are already at least five years past a peak in electricity generation from fossil fuels.” These countries represent 38 percent of global electricity demand. Even better, countries that are at least one year past a peak in fossil power use represent half of global demand. This portends that the world as a whole is very near peak fossil use for electricity generation. If not this year than probably in 2024 the world will start seeing an ongoing decrease in use of fossil fuel for electricity generation. In fact, the EU, Oceania and North America have seen fossil generation “drop by 30%, 20% and 15%, respectively, from their regional peaks.” Asia has not yet seen a peak, mainly because of China and India, although both Japan and Vietnam have seen decreases in fossil fuel generation for electricity. But there’s good news in China, too. The International Energy Agency is now forecasting that China’s fossil fuel peak is this year and will start to decline in 2024. Climate change continues to be a challenge but real strides are being made.

Is Diversity a Scam?

No, this is not some sort of weird anti-woke screed. We’re talking about diversity of supply chains. We’ve been arguing, using data and anecdotes, that global supply chains have been diversifying out of China for a number of years and then began accelerating after Xi’s Zero Covid policy showed it was unwise to have all your eggs in one basket. People used to argue such diversification wasn’t happening. But now that it’s obvious companies are moving parts of their supply chain out of China some people now argue it’s not real diversification because it’s Chinese companies who are setting up shop in other countries. These folks argue this is not really diversifying of supply chains. It is true that in countries such as Vietnam, many of the new factories are operated by Chinese companies. The chart below showing FDI into Vietnam very much illustrates this with China now the largest investor into Vietnam when measured by number of registered projects. By capital it’s number two with Singapore number one—though lots of that Singapore investment is likely actually Chinese investment given all the wealthy Chinese who have moved there to escape Xi’s authoritarian China. So perhaps from a geopolitical viewpoint, supply chains aren’t completely diversifying from China*, but from a supply chain standpoint, they are. The problem was when things went south in China, such as during Zero Covid or when the government cracks down on industries, a company’s supply chain was jeopardized. A factory in Vietnam, even one owned by a Chinese company, is still diversifying a company’s supply chain when things are shut down in China.

*Even from a geostrategic view, it is helpful that factories are outside of China, even if owned by Chinese companies. This moves capital out of China, provides expertise in manufacturing to other countries and provides leverage over these Chinese companies.

China Corner: The Power of China

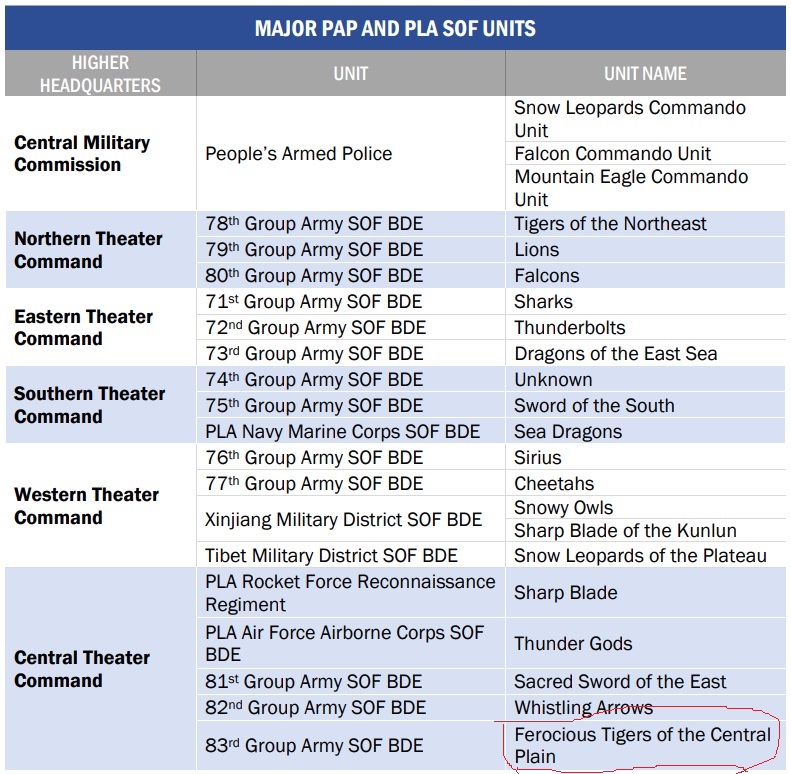

Seems like an opportune time given China just rammed two Philippine ships trying to deliver supplies to a shoal off its coast (something we warned about a few weeks ago)* to take a look at the U.S. Department of Defense’s new “China Military Power Report” China continues to rapidly build up its military capabilities as it aspires to be a world power. The report notes that “The PRC has numerically the largest navy in the world with an overall battle force of over 370 ships and submarines, including more than 140 major surface combatants.” These are mostly modern ships. China added a third air craft carrier last year with a fourth on its way (though we wonder if air craft carriers are sitting ducks in the modern military environment). China also has the largest aviation force in the Indo-Pacific region. It’s also building up its nuclear forces rapidly, now possessing more than 500 operational nuclear warheads and likely to have more than 1000 by 2030. The report states, “The PLA is aggressively developing capabilities to provide options for the PRC to dissuade, deter, or, if ordered, defeat third-party intervention in the Indo-Pacific region, and to conduct military operations deeper into the Indo-Pacific region and globally.” What could go wrong?

We have no reason to display the above table other than to note that our next fantasy sports team will be named the “Ferocious Tigers of the Central Plain.”

*The U.S. issued a strong statement in support of the Philippines and noted America has a defense treaty in the Philippines. As bad as things are in Israel and Gaza, a military confrontation between the U.S. and China would be ever more dangerous.