We sat in a comfortable chair of the wood paneled office of a retired CEO’s old Kentucky home in Lexington. Horse memorabilia and art decorated the room. A large painting of a jockey. A bronze statue of a horse. We were accompanying an old college friend who once worked for this CEO many years ago. The tall man with a full head of wavy white hair had run the large company, one you would recognize, for many years and recently retired from its board of directors. Before arriving at the gentleman’s house, our biases—we all have them of one sort or another—began to frame a narrative of the man and his wife though we had yet to meet and knew very little about the guy. Our assumptions about this grand old couple living in their sumptuous house were wrong.

We learned more about them afterwards, including listening to a podcast about how this man helped found and grow his company. He comes from a middle class background and essentially had little money until he was almost 50 years old. His wife comes from old Kentucky gentry and stuck with him through thin into the middle age years when thick business success finally came and now into their golden years. They are both more complicated than any assumptions we conjured, we all are. As Count Alexander Rostov notes in A Gentleman in Moscow, “By their very nature, human beings are so capricious, so complex, so delightfully contradictory, that they deserve not only our consideration, but our reconsideration–and our unwavering determination to withhold our opinion until we have engaged with them in every possible setting at every possible hour.”

We were last in Kentucky decades ago and that mostly was driving through the blue grass towards destinations further south. We were only there briefly on this trip, to Louisville as well as Lexington. If we ever have time, we would like to consider and reconsider the place more. In the meantime, we check our biases while asking whether Africa is too expensive, explore South Korea’s EV export success and examine China’s scientific prowess. It’s this week’s International Need to Know, the Louisville Lip of international information, the Louisville Slugger of global data.

Without further ado, here’s what you need to know.

Are African Prices Too High?

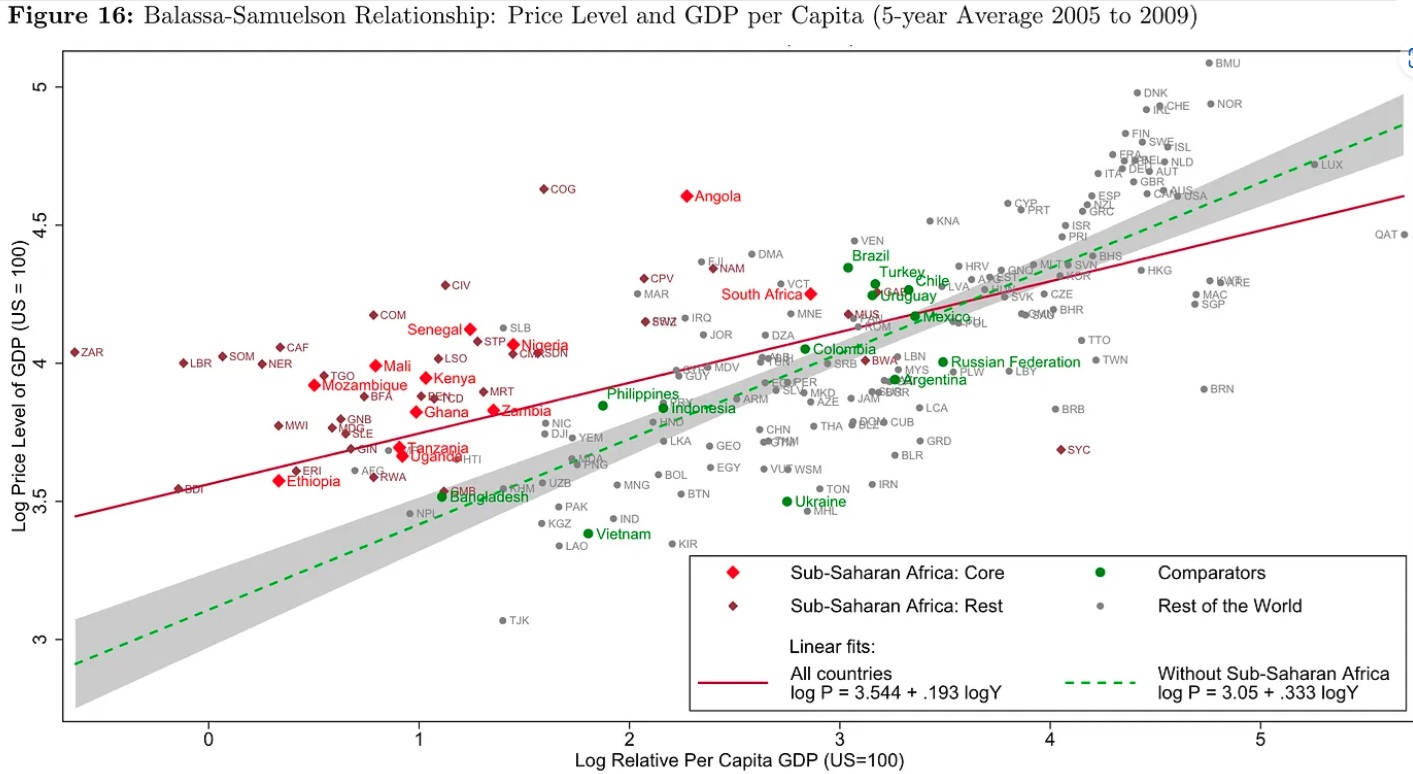

We’ve been predicting that a number of African countries will be among the world’s next fast growing developing economies, African lions to past Asia’s tigers. As costs go up in places like Vietnam, producers will inevitably look to other locations. But development economist Oliver Kim asks why African manufacturing has not yet taken off. He notes that “Manufacturing in Sub-Saharan Africa is stuck at less than 10% of GDP, compared to 24% in East Asia and even 17% in Latin America and the Caribbean” He then points to a paper as evidence that one of the reasons for failure to take off is that “though African countries are quite poor, African factory workers’ wages are relatively high. More specifically, industrial labor costs in Africa are high compared to non-African countries at similar levels of GDP.” I frankly don’t understand the rest of his blog post so let’s stay with this point for a moment. Relatively high industrial wages compared to other developing countries would be a competitive disadvantage to attracting manufacturing. Kim tries to explain why the wages might be high but runs the explanatory car off into a ditch full of expository knotweed, at least to my reading. Logically certain African countries should start to attract manufacturing over the next decade. If this does not happen we really need to understand why not (confusing blog posts or not).

South Korea’s EV Exports (and the China Effect)

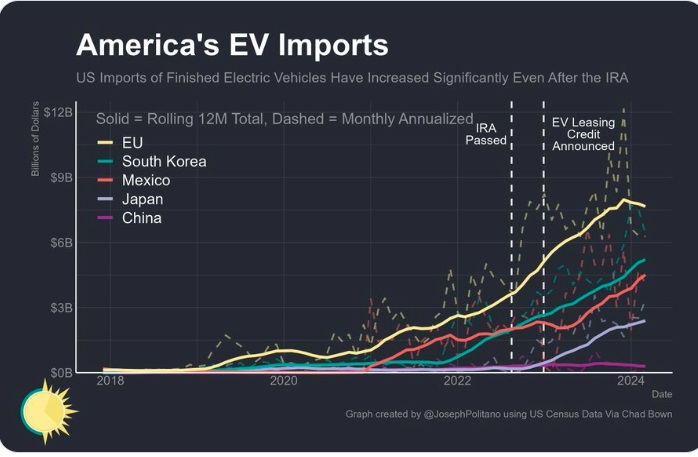

The U.S. has not been importing many EVs from China and with the imposition of high tariff rates by Biden won’t be for the foreseeable future. So where is America getting its EVs from? Well, as Joey Politano points out, increasingly from South Korea: “So far in 2024, the US has imported more EVs from Korea than any other country, and over the last 12M they’re 2nd behind the EU.” Looking at the graph that Politano supplies (see below) what’s interesting is not only the increase in South Korean EV imports but the decline of the EU. And also interesting is the increase from Mexico, where increasingly Chinese EV makers, including and especially BYD, are setting up shop. The U.S. is a large market for cars and so the battle for market share here is important. But what will Chinese companies gaining market share in non-U.S. and non-EU markets mean for non-Chinese automakers’ futures, whether Korean or otherwise? Guess we’re going to find out since lots of non-U.S. and non-European countries are going to buy Chinese EVs.

China Corner: How Good Is China in Science/Tech?

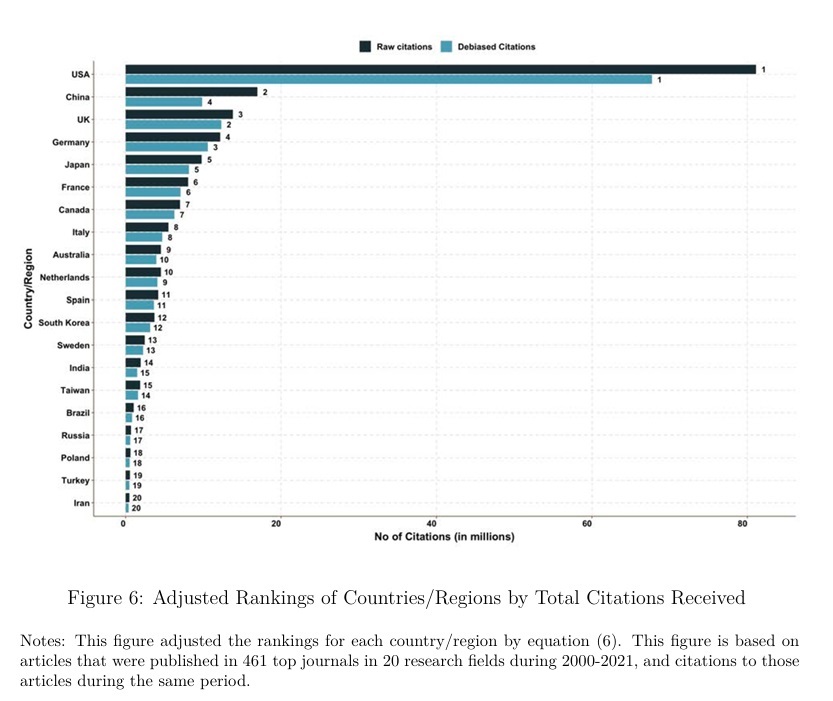

This is a big topic nowadays with U.S. and European industrial policy efforts implemented partly because of China’s dominance in a number of industrial technological areas such as batteries and solar panels, as well as because of worries China could come to dominate in other strategic sectors such as semiconductor chips and AI. Our sense is that China is doing well and likely to continue to do well going forward but also that some folks overrate China’s science and tech dominance. A new paper “Paper Tiger? Chinese Science and Home Bias in Citations” published by the National Bureau of Economic Research (NBER) states there is a “home bias” in Chinese scientific citations. That is, “We develop a benchmark for expected citations based on the relative size of countries, defining home bias as deviations from this norm. Our findings reveal that China exhibits the largest home bias across all major countries and in nearly all scientific fields studied.” We knew that China has incentives for citations, which of course means Chinese scientists are going to cite a lot. This paper quantifies it. So where does the paper place China globally in scientific citations: “Our adjusted ranking places China fourth globally, behind the US, the UK, and Germany, tempering the perception of China’s scientific dominance.” Okay, maybe China’s not dominant but fourth is still pretty good. Where will they rank ten years from now? Twenty years? Xi’s increasingly closed system may hurt China going forward. China’s pouring tons of resources into science may help it.