I was an early consumer of blogs. Like many things in my life, it was driven by the Seattle Mariners. At the dawn of the blog age, sites like USS Mariner, Lookout Landing and others were the best, most intelligent way to understand my favorite baseball team. But I also slummed it and read a number of political and economic blogs as well. Most of them fell by the wayside, or transformed as social media ruled the media landscape. But not Kevin Drum. He had his own independent blog, then was hosted by Washington Monthly, then by Mother Jones and then struck out on his own again. He was consistently data focused, using charts to make a point or examining charts to understand our world better. He was also more often than not a voice of reason—using data to show things aren’t as bad as you think, or providing a longer term perspective. More than once I’ve referenced his work in this space or been inspired by something he wrote to do further investigation. Of course, I also loved his Friday Cat Blog posts, where he displayed a photo of one of his cats doing one cute antic or another. Most mornings Drum’s blog would be one of the first things we read.

Drum was always invaluable but at the dawn of Trump II, he was crucially so—posting about one Trump outrage or another with cogent commentary, with helpful charts to understand what was being done to our country. He accomplished this even in his final days, while in the hospital, dying of cancer, but somehow continuing to post with intelligence and usefulness. I did not know Kevin Drum, but it sure felt like I did, having read him for 20 years. It feels as if I’ve lost a friend. And more important, as I wrote about my former boss U.S. Representative John Miller, when he died a number of years ago–at a time when the world needs more people like Kevin Drum, the world has one fewer. RIP and thoughts for his wife and cats.

Without further ado, here’s what you need to know.

The Great Realingnment

Last week, we noted the likelihood of nuclear proliferation due to the U.S., with help from China and Russia, pushing us back to 19th Century geopolitics. Sure enough, Poland has announced that it may acquire nuclear weapons from France. Expect many more countries to go nuclear. in the coming months and years. But beyond nuclear weapons, we are witnessing a major military realignment. Europe is looking to boost production and spending on their militaries, with announcements by Germany, France, Poland and others. The U.S. is the world’s largest arms seller. But not only have its security guarantees become unreliable so too perhaps are its weapons. Reports over the weekend claimed that U.S.-supplied F-16s in Ukraine had stopped working and that the U.S. had activated the ‘kill switches’ on these planes. Germany is set to receive F-35 aircraft next year, but some in the country worry that the U.S. could deactivate them at will. Others dispute whether this is possible. Regardless, it is entirely understandable why Europeans and others would be nervous about buying U.S. arms in the future. Not to mention there will be new military alliances negotiated given the U.S. is no longer a reliable partner (neither in security nor trade, nor anything else for that matter). Witness Canada and the Philippines negotiating a new military agreement to bolster security in the South China Sea. The 19th Century returns and countries adjust accordingly. Bonus stock tip: Buy foreign defense firms.

Globalization Not Going Away

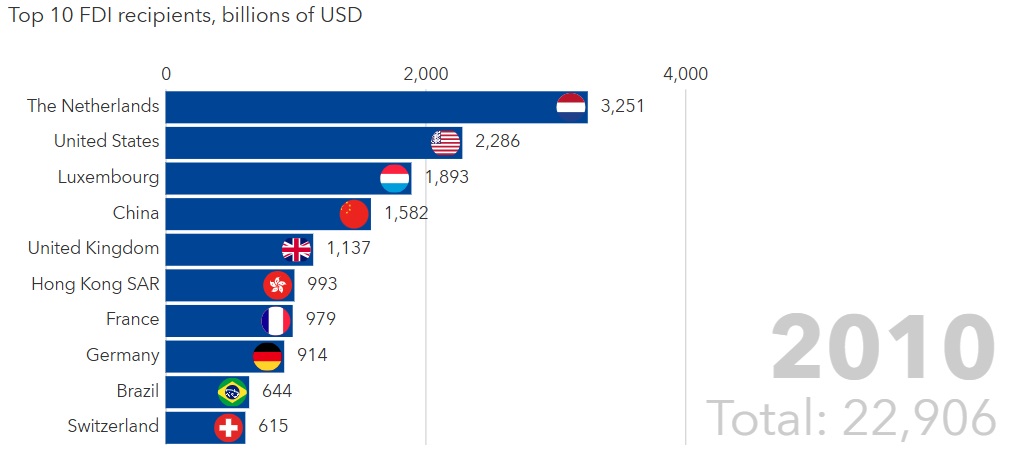

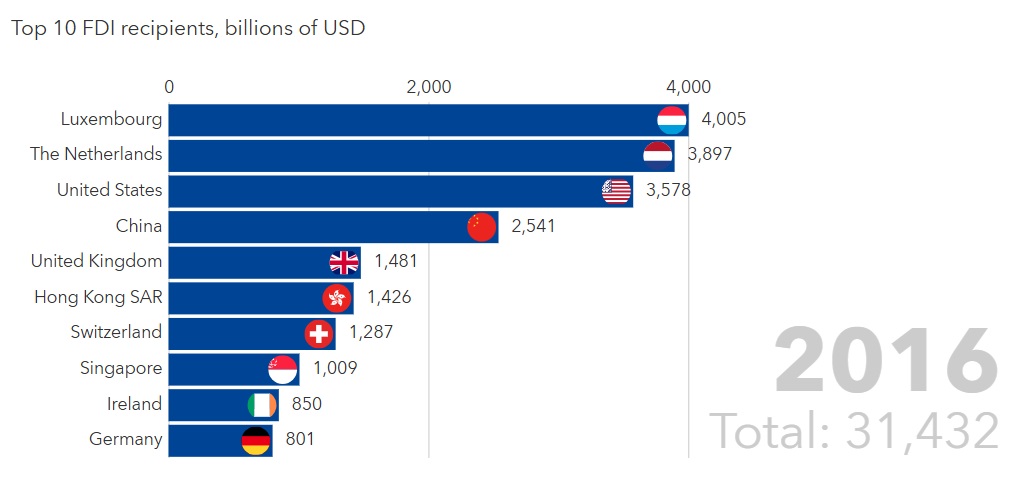

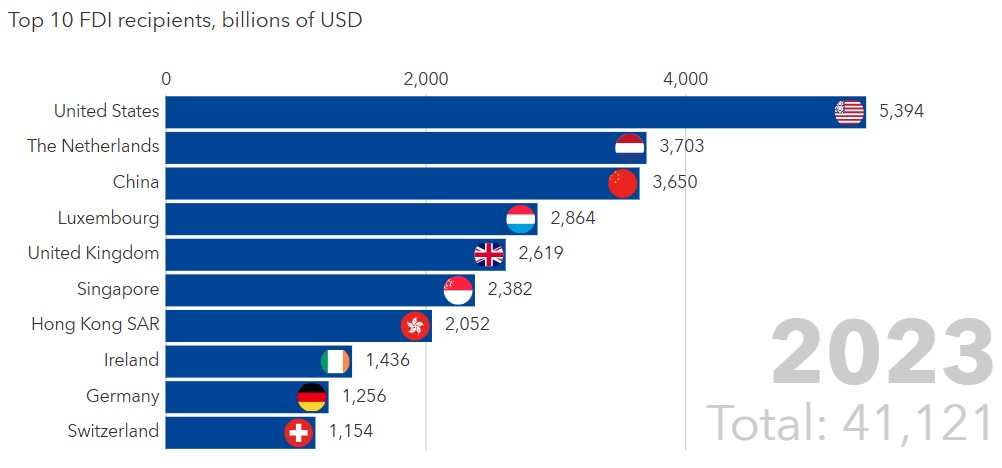

We continue to hear pundit medical examiners claiming globalization is dead or dying. In recent talks and presentations we’ve discussed what globalization is and asserted that it is not going away. Globalization is the movement of goods (trade), the movement of people, the movement of ideas and the movement of money. I’ll talk about the other three someday but for today let’s discuss money. It continues to move around the world in increasing amounts, whether measured by turnover of global foreign exchange, foreign direct investment or other measures. Global foreign investment increased in 2023. The destination of these investments changes over time, as you can see in the charts below. But the overall level for the most part keeps increasing. There are two ways we see globalization ending: nuclear war (which, of course, would destroy everything, not just globalization) or super artificial intelligence. The latter could transform the world in a multitude of ways, including changing how we manufacture. Actually, we don’t think AI would end globalization, or at least not the people, ideas and money parts. But it might limit trade in goods if automation allows for manufacturing and customization in each locale rather than today’s global supply chains. But who knows if AGI is coming and what its effects will be. And let’s hope nuclear war does not come. In other words, globalization is not going away unless disrupted by a major event, either positive or negative.

China Corner: Follow The Money

Most people think this was actually said by Deep Throat (who turned out to be Mark Felt, former FBI assistant director), but in fact it was an invention of the great screenwriter, William Goldman (who wrote Butch Cassidy, Princess Bride and many other wonderful films and books). Fact-based or not, it’s still good advice and we follow it in China with these examples:

- China continues to increase defense spending, this year by 7.2 percent. Since Xi Jinping took over just over 10 years ago, China has more than doubled its military budget.

- You can also see where China is concentrating its resources through its rise as the world’s largest cyber espionage player. “CrowdStrike identified seven new China-nexus adversaries in 2024, fueling a 150% surge in espionage attacks, with critical industries seeing up to a 300% spike in targeted attacks.”

- And it’s building ships. A lot of them. CSIS reports, “Today, the PRC boasts the world’s largest navy by number of vessels and is on track to reach a 425-ship fleet by 2030.”

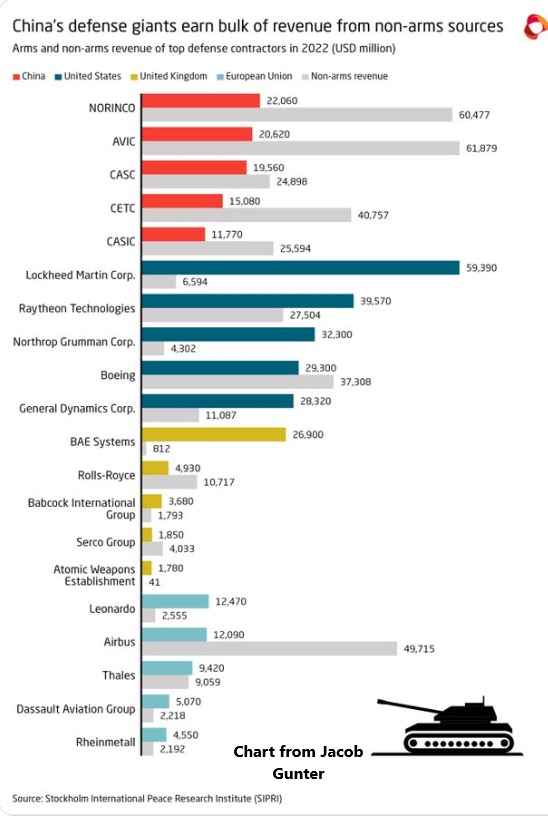

- BUT Kyle Chan informs us where Chinese defense firms derive most of their revenue from—non-arms sources such as auto manufacturing.

Where is this money leading us to? Read our next Substack article to find out, likely coming out next week.