He sat unobtrusively in the right back corner of the stage away from the lights and audience. And yet, he was the leader of the band. In fact, the band’s name featured his name: The Danny Gatton Trio. And when the songs featured a guitar solo, which they inevitably did, it mattered not where Danny Gallagher sat or where he tried to hide: his music, his notes, his virtuosity and talent were front and center filling the small room. I had recently moved to Washington, D.C. and didn’t know anyone. But a bar across the street from my apartment advertised free music on Thursday nights (then and now beginning congressional staffers were paid like the McDonald’s workers some members of Congress want to increase the minimum wage for. Some may argue both provide similar nutritional content). It seemed like a good way to get out of the apartment as we navigated our new job and city. And so that’s how we found one of the world’s great guitarists, in a tiny club mere steps from where we laid our head to sleep each night. Danny Gatton achieved a very brief, very modest measure of fame and recognition in the early 1990s. And then he killed himself. Perhaps whatever drove him to the shadows on stage also impelled him to take his life.

We were reminded of this when a friend recently posted on Facebook a video of John Fahey, another long forgotten guitar virtuoso and provoking another friend and I to reminisce about seeing a double bill of Michael Hedges and Leo Kottke in the late 1980s, two guitar wizards themselves. Of course, the guitar itself is now no longer stage center as new musical genres featuring other instruments have long since clambered to the front. Eventually, we all take our turns center stage, in the shadows and off the pedestal completely. Even the current pandemic, which has so dominated our lives the last twelve months, will recede into the misty music of memory. In the meantime, we move to the forefront the effect of Covid-19 on developing countries, another medical breakthrough, and capital flowing to China. It’s this week’s International Need to Know, in mid-season form even as we enjoy the crack of the bat and pounding of the ball of early spring training baseball.

One hears much disparagement of the Internet nowadays but if it ends up destroying the world it would have been worth it for our finding this clip of an obscure master musician playing in a long-gone obscure bar

Without further ado, here’s what you need to know.

Developing Countries’ Economies and Covid-19

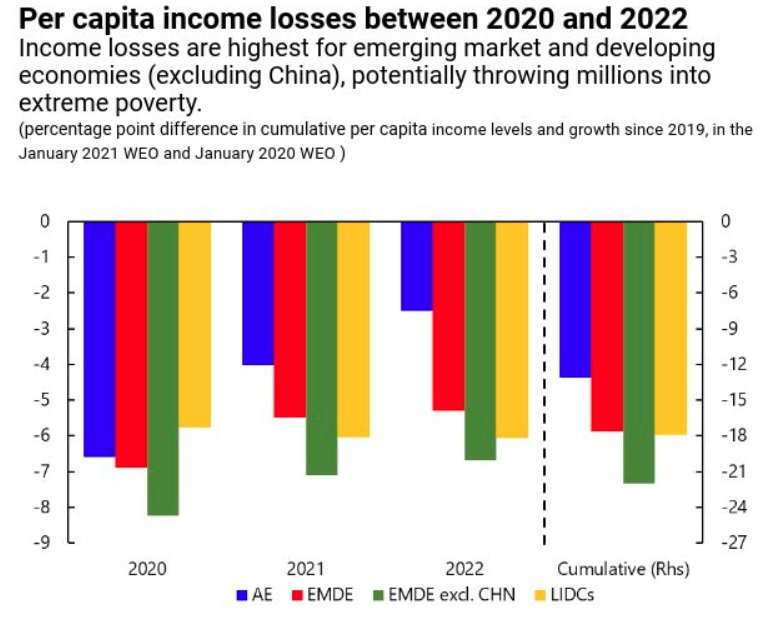

In a surprising twist, for the most part developing countries have fared better than developed ones health-wise with Covid-19, according to the IMF. For whatever the reasons, there have been fewer infections and deaths in emerging markets and developing markets than in the developed world. But that does not mean their economies have fared better. As we have repeatedly reminded, we are all in this together, and no economy does well until the pandemic is defeated. And overall, developing countries economies have been hit harder, as you can see in the IMF graph below. Further, the IMF estimates developing counties will do worse over the nest two years with GDP per capita growing more slowly. The gap between rich countries and poor, which had been shrinking in recent decades, is at least temporarily now growing wider again and will likely grow even more this year and next if vaccination rates proceed on their current trend, which is to say poorer countries will be vaccinated at a much slower rate. This will hurt their economies and increase the chance for new more dangerous variants to evolve—and that will eventually kick back to developed countries economies. But the slow pace of vaccinations in the developing world is a choice made by the developed world. We’re all in this together.

Another Possible Medical Breakthrough

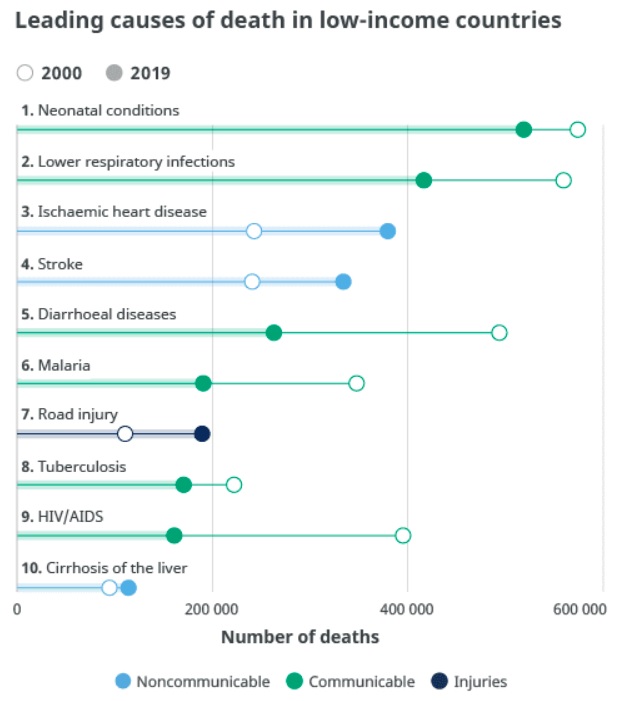

Our world is tuned to pessimism. It is what rocks our media world, impels people to rap on social media platforms, and surges endorphins into those taking the daily stage of the chattering sturm and drang. But ye who have ears to hear and eyes to see, listen beyond this sonic wave of dread, darkness and continuous alarm to see that not only were the last seventy years ones of stunning progress but that the next seventy could easily be too if we don’t throw away the tools, institutions and policies that got us to where we are now. To cite just one recent example of a reason for optimism, remarkable progress has been made on a vaccine for malaria, the sixth-leading cause of death in low-income countries and a disease that has been a continuous drag on economic development in these countries. But news arrives this week that using mRNA technology—the breakthrough that allowed for remarkably effective vaccines against Covid-19—scientists may have developed an effective vaccine for malaria. Well, technically they are using an saRNA platform: “The proposed saRNA vaccine tells the body to create the troublesome PFIF protein, generates antibodies against it and naturally produces the necessary memory T-cells…” The scientists who have developed this and applied for a patent, are now working with Oxford University with the hope of starting phase 1 human trials. There is an existing vaccine for malaria approved two years ago but its efficacy is low and not long-lasting. We have high hopes for 2021 and beyond and assess that the chances of our hopes being fulfilled increase if more people understand what is going on around the world rather than being enveloped in ignorant darkness.

China Corner: China is Not the Soviet Union

Our book Challenging China, which will be released one month and two days from now (if you haven’t pre-ordered yet, you are the literary equivalent of an anti-vaxxer. Don’t act like Jenny McCarthy, order now), notes that dealing with China is very different from the Cold War with the Soviet Union. For one thing, China’s economy is far more entwined in the global economy than the Soviet Union’s ever was. The latest example of this comes from the Financial Review which notes that “Investors from New York to London, Amsterdam and Auckland are scrambling to find a way into the world’s fastest-growing capital market.” China’s bond market is attracting cash because of its higher interest rates and thus far investors are not concerned about China’s increasing authoritarianism, genocide against the Uyhgurs or the possibility of the government making it difficult to get their money out of the market. The article notes that China is trying to manage outflows of money to curb inflationary and currency appreciation issues. China recently loosened the US$50,000 annual restriction on Chinese taking money out of the country. What route is the outflow of Chinese money taking? Often through Hong Kong, where China has instituted a political crackdown and last weekend formally charged what was left of the most prominent democratic protesters. When the world looks to how to deal with China, the Soviet Union Cold War will not offer great answers.