Russian Sadness, Spanish Storms and Where the Muslims are

As we place our iPhone in a dark corner far from prying FBI eyes, watch a campaign manager get charged with literally twisting arms, and gaze upon 10% of the Cuban population rocking out with Mick, Keith and the gang, we cast glum eyes on the wreck that is Russia, worry about the long-term health of Spain and list the perhaps surprisingly largest locations of Islam.* Yes, it’s this week’s International Need to know, bringing the sanity of facts and figures to a world seemingly head over heals in love with crazy.

Without further ado, here’s what you need to know.

The Sadness that is Russia

There are many bears in this world. The polar bear is unfortunately threatened by climate change. The Chicago Bears will never surpass my beloved Green Bay Packers. Yogi Berra left this world last year. But perhaps the saddest bear these days is Russia. While Vladimir Putin poses sans shirt like a crazy Uncle at a drunken family reunion, the country’s economy continues to struggle.

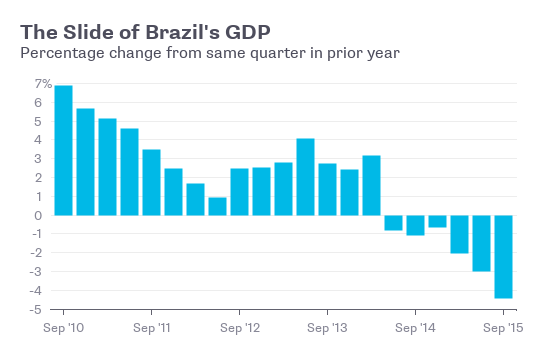

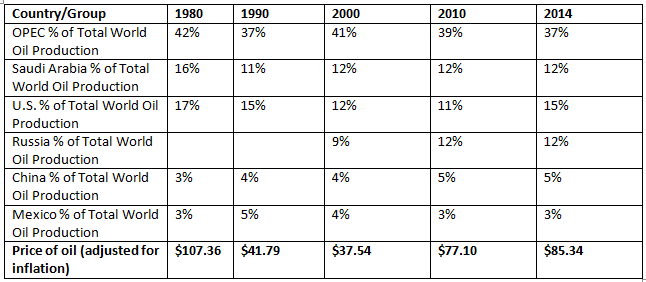

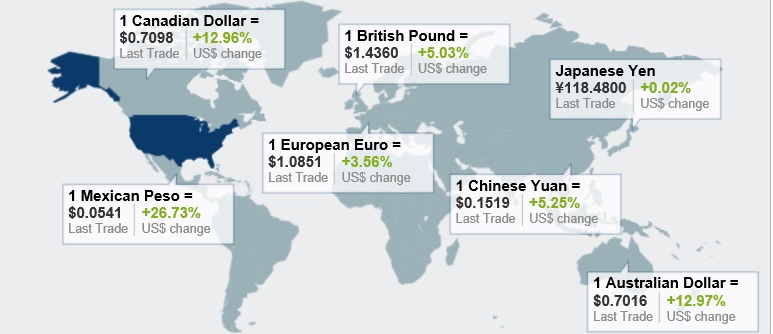

Raising the minimum wage is all the rage nowadays. We see California is considering raising the state minimum wage to $15 per hour. Russia is in on the act as well, raising their minimum wage this week yet again, by 21 percent. This comes after a 4 percent increase in January. The Russian economy is a mess. More than 20 million Russians, about 14% of the population, are now living in poverty, up from 16 million in 2014. These are the official statistics but it would be no surprise if the numbers are much greater than that.The Russian economy contracted 3.7% in 2015 and so far it’s getting smaller this year too. Vodka exports are down 40%, which is bad for the economy, but perhaps good for Russians who need a stiff drink in bad times, but bad because of Russian’s huge alcoholism rates. Two drunken steps backwards for every step forward seems to be the norm there. In fact, Russia is perhaps the only country where life expectancy is getting shorter, at least for males, due to alcoholism and disease. Some of the economic problems are due to sanctions and to an economic climate mired in corruption. But oil prices play a role too. Nearly half of Russia’s government revenue comes from its oil and gas exports. With prices remaining at a low level for over a year, Vladimir Putin is like a vicious Jed Clampett who has run out of black gold. INTN once knew lots of people doing business in Russia. Now we can count them on one hand.

Long Spanish Storms

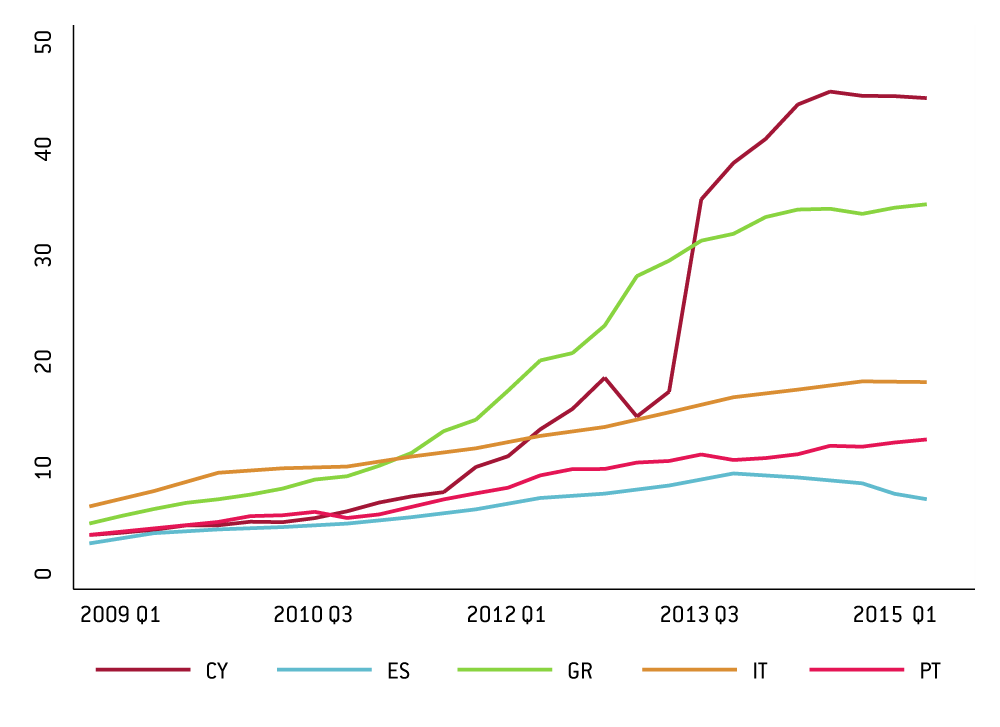

Much of Europe is still in distress despite some marginal improvements the last year. Usually we think of Europe’s problems as a result of the financial crisis, austerity and a currency union absent a fiscal union. But Spain, which puts the plural in PIIGS (Portugal, Italy, Ireland, Greece and Spain), the countries that were most in distress a year or so ago, may tell us otherwise. I recently came across the graph below. This shows Spain’s economic growth below trend since 1978. It’s possible the problems of the EU, or at least parts of it, are more long-standing and complicated then we think. Some of these economic difficulties are like a blues soul song, a long time coming.

Where the Muslims Are

Via the Pew Research Center, we find that the largest Muslim populations are not in the Middle East but in Asia. Strangely enough, I have not see any calls for banning Indians from coming to America.

1. Indonesia, 205 million

2. Pakistan, 178 million

3. India, 177 million

4. Bangladesh, 149 million

5. Egypt, 80 million

6. Nigeria, 76 million

7. Iran, 75 million

8. Turkey, 75 million

9. Algeria, 75 million

10. Morocco, 32 million

*Yes, we have promised a dive into the deep end of the Chinese banking system but we’re still assembling our mask and oxygen. Stay tuned!