Life in the World of Trump, What to Expect Internationally, and Who Needs Talent

I tell those who are afraid of flying that it is not the flight you should be scared of, it’s the taxi ride at the end of it. I have been nearly killed in at least half a dozen cab rides in different locations around the world. Last week in a small town in Eastern Washington, my cab driver was very safe, kind and his life story enlightening. He drives a taxi because he lost medical clearance to drive a truck when he developed numbness in his hands, eventually requiring surgery to fuse two neck vertebrae together. He became a truck driver for the good pay (far better compensation than cab driving) and health care since he was a single father of two twins. He was a single father because his first wife had mental health problems, refused to take her medication, turned to drugs and alcohol, became violent and generally unstable and unsafe for their children. He met his second wife at church and is seemingly a very good father to her kids, whom he referred to as his kids, not step-kids. He says they live in “a good Christian town where there’s seemingly a church for every two people.” But he and his wife have not been to church in eight years. For him, religion was a social valve. He is seemingly a good dad, good husband, and has experienced much economic hardship and bad luck. He told me he didn’t like his presidential candidate choices…but, he was going to vote for Donald Trump. If we had been paying closer attention to such stories, perhaps we would not have been so surprised Tuesday night. Sometimes the most foreign of countries is your own. So, this week we gaze at America briefly and what the election means for our global economic order, examine a few likely international trade policies of the Trump Administration (will it be rebranded the “Trump House”?) and then head back into the world in search of who needs talent. It’s this week’s International Need to Know, remembering that the wisest words anyone ever says are “I’m not sure.

Without further ado, here’s what you need to know.

A New World Economic Order

America and politics are not our beat. But, although there are many ways to interpret Tuesday’s vote, placing it in the context of Brexit and electoral and political winds blowing in other parts of the world, it appears people are fed up with the current global economic infrastructure, and new players, both in America and abroad, in democracies and authoritarian governments, are ready to upend our current world order. That is our beat, or is at least part of it. As we have written before, we live in the most peaceful, prosperous time in the history of humans. The institutions, values and norms created out of the ashes of World War II, flawed as they are (and all human creations are imperfect), for the most part served us well. We here at International Need to Know will dance and sing in the second line at their passing. But, all things end and the world is changing, and changing rapidly. Technology has radically transformed how we communicate with each other. We appear to be on the brink of technological changes that will transform how we work (and if we work), how we transport ourselves, our capacity for violent destruction and how our privacy is kept or more likely is not. There are profound demographic changes occurring all throughout the world. Perhaps people grasp this in their gut even if they do not fully run it through a Nate Silver algorithm. This is not to dismiss the many less savory reasons for why people want to upend institutions and voted for Brexit and change in the American political landscape. The unifying emotion driving the demand for change is, of course, fear. Perhaps this fear is well-founded and we need to change the current international institutional infrastructure and culture to address a changing world. But if so, the big question is what takes its place? No one currently has the answer and this question does not even appear to have been thought about by those demanding change. We don’t know the answer either but I expect we will take a turn on the global policy dance floor, two-stepping and spinning our partners with some ideas in the weeks and months to come.

What to Expect Internationally

Although in many areas, Trump was remarkably vague about policy, in a few international policy realms he was consistent both verbally and in writing. I think we can all assume the Transpacific Partnership (TPP) is dead. In other areas of trade, Trump has said he will:

- Tell NAFTA partners that “we intend to immediately renegotiate the terms of that agreement to get a better deal for our workers. If they don’t agree to a renegotiation, we will submit notice that the U.S. intends to withdraw from the deal.” In those negotiations he hopes to institute a fee on Mexico imports into the US that he would use to build his wall. Not coincidentally, on election night we saw the largest decrease of the peso against the dollar since 1994.

- Instruct the Treasury Secretary to label China a currency manipulator. This basically means the U.S. would have to negotiate with China on adjusting their rate of exchange. It’s unlikely to have much practical effect and China’s exchange had and has little to do with the U.S. trade deficit with China. But, Trump says any country that devalues their currency (currently almost everyone), “will be met with sharply, and that includes tariffs and taxes.” If so, will countries retaliate with their own tariffs and taxes? I vaguely remember from history books and economics that this may not turn out so well.

- He will bring a bunch more suits against China at the WTO. At the pace the WTO resolution process works, the Seattle Mariners will win a World Series before anything of substance results from these complaints. But here too, he threatens to institute taxes and tariffs. What it will mean for relations with China and how China will react, is an open question.

Who Needs Talent?

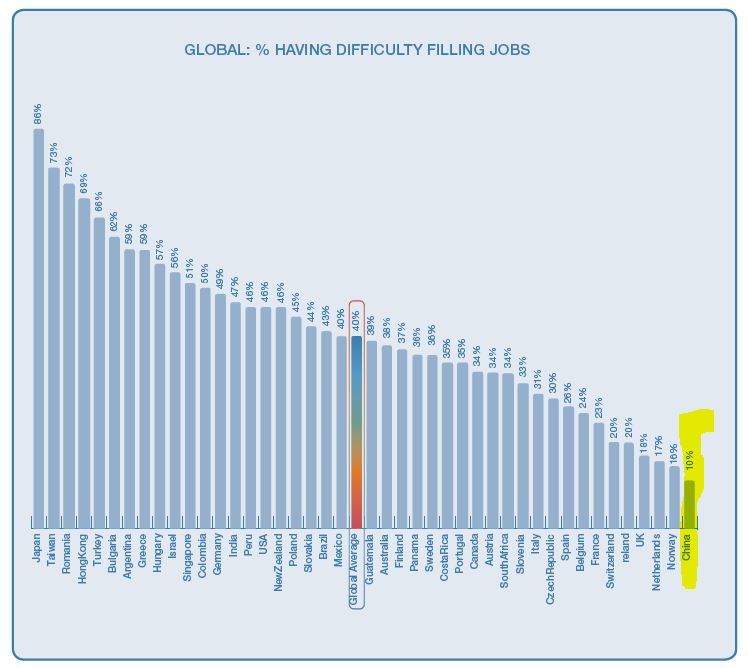

But enough of such weighty matters, new world orders and what our future holds. Let’s talk about talent. Specifically, which countries have the most difficulties filling jobs because of not enough available talent and in which countries is filling jobs not difficult? We go to the Pacific Rim for both answers. As you can see in the chart below from ManpowerGroup (who can continue to keep their company’s name after Tuesday’s electoral results), 88% of Japanese employers report having trouble filling jobs. That is certainly a reflection of the aging demographics in Japan where the population is actually shrinking. Taiwan is high on the chart as well and for reasons of which we are in the dark, so is Romania. On the other side of the ledger is China, where companies have the least difficulty filling jobs. As always with this ever complicated country, there are many ways to interpret the ease with which Chinese companies can fill jobs: lots of talent, a slowdown in the economy, not enough jobs requiring talent and many other ways. We expect the new U.S. administration, if it pays attention to such data, will have an interpretation of its own.

More on Peak Oil (Usage), European Immobility and Who Cares in the World

(Caution: Parts of the following was written early in the morning after the 2016 World Series [congratulations Cubs! Once every 108 years without fail]. We cannot vouch for veracity, grammar or decency but like the Cubs and Indians, we left it all out on the field.

International Need to Know is attending a Homeland Security Conference this week, working with a company that has excellent applications relevant to such endeavors. While talking with an Army commander at the conference we realized anew how fast (relatively) things change in our geopolitical world. Today’s enemies are tomorrow’s allies, vice versa and in many other combinations. The Army commander, who deals with asymmetric threats, told us about traveling to Vietnam to study the tunnels used by the Vietcong against America during the war there. He and his American military colleagues met with and were guided by the Vietnamese military and are using the information to apply lessons to today’s threats, including from ISIS. If you told a military commander in 1971 that his successor would be hanging with and working with the Vietnamese military, they may have thought you’d been exposed to Agent Orange. So we keep our fast changing world in mind even as we tunnel for more evidence of peak oil usage, examine the immobility of much of Europe and wonder who in the world cares the most. It’s this week’s International Need to Know, like the Godfather of international information, keeping friends close, enemies closer and everyone else nearby too.

Without further ado, here’s what you need to know.

Update on Peak Oil (Usage)

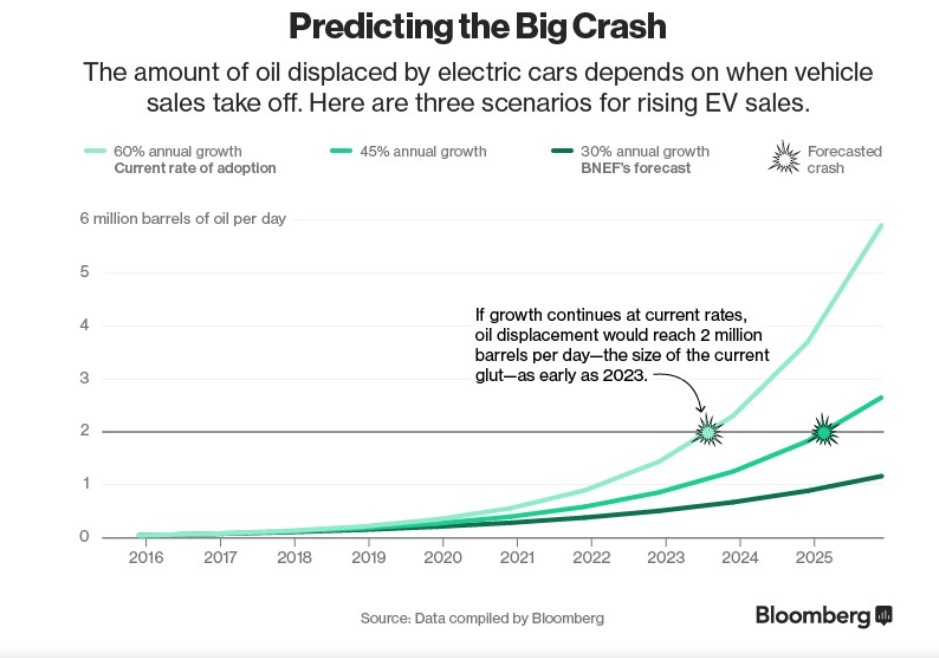

The rest of the world is starting to catch up to INTN’s bold prediction that peak oil (usage) is coming sooner than we think. Bloomberg New Energy Finance (BNEF) has a new study out that asserts the rise of electric vehicles could cause an oil crash similar to what we saw beginning in 2014. This could happen as early as 2023, a mere six years from now. Their thesis is that in 2015 the oil price collapse occurred because of a global oil glut of 2 million barrels per day. BNEF’s analysis is that if electric vehicle sales continue at their current rate, they will displace 2 million barrels per day of oil usage by 2023. And thus, another collapse in oil prices. However, they don’t think global electric vehicle sales will continue to increase as rapidly as they are today and so think more likely the oil price collapse won’t come until 2028. The chart below shows three different growth rates coupled with when oil displacement rates would reach 2 million barrels. Interestingly, Norway recently announced it is planning to ban the sale of new gasoline- and diesel-powered cars starting in 2025. You know Norway, the country that is one of the major oil producers. The world is moving quickly, including in the energy sector. But, as we have pointed out, electricity needs to be generated cleanly if this is ultimately going to be good for the environment. However, with the rapid improvments of solar, we expect that will be the case, certainly by 2030. So this is good news for the environment but expect some major disruptions to the world economy as it happens. In 20 years will Exxon be tweeting like The Last Blockbuster Store?

Going Mobile

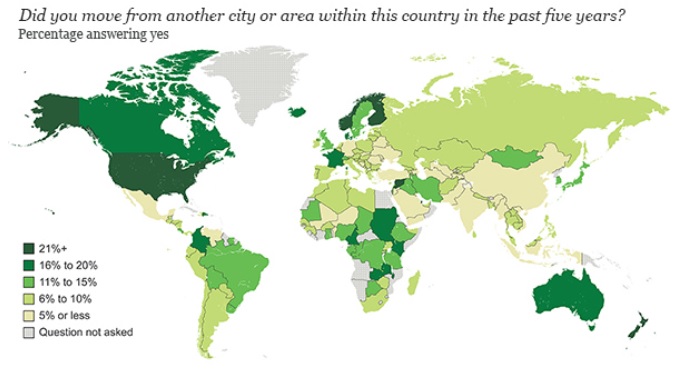

Last week we discovered that 70% of high skilled talent moves to only four countries. But what about movement within countries? The U.S. is known for having a mobile population from its earliest days when people fanned out west from the East Coast. And, it’s true, America is more mobile than other countries, especially Europe. According to a Gallup Poll, about one in four Americans “reported moving within the country in the last five years.” Only Finland, Norway and New Zealand move around in their countries as much as Americans do. The rest of Europe, not so much. Many Europeans I know have never moved more than 20 miles away from their hometowns. But there is even less internal movement in Venezuela and China which is surprising given the huge urban migration in China the last 30 years, but perhaps that great migration is slowing down. We have seen other evidence of a slowdown in this migration in recent years. Internal mobility can be beneficial to job matching. As job categories go away, being willing to move to find a new job can be crucial. If we face a slew of job destruction from automation in the next twenty years, mobility may become even more important.

Who Cares?

You may think the United States is the most charitable nation on earth but you would be wrong. America is second. Myanmar of all places is the most giving nation on earth, according to the Charities Aid Foundation’s (CAF) annual World Giving Index (I believe there is now an index for every single possible thing that can be ranked in our world–charity, economies and worst Kardashian*) Myanmar earned the top spot through “high levels of participation by donating money (91%) and volunteering (55%).” The Index also ranks which countries are most likely to help a stranger. The people of Iraq top this list with 81% of Iraqis helping a stranger. In fact, Middle East countries dominate this category as you see in the chart below. This matches up with my experiences in that part of the world where I have always found the people to be the most hospitable of any I encounter. With that, we exit our worldwide headquarters to help an old lady cross the street…

*No it’s not a seven way tie for last.

Where Talent Moves To, What the Chinese are Investing in, and Who is Drinking

In a world of short attention spans, segregated news sources and fetishes for frivolity, what people become famous for has changed. Jane Espenson, an accomplished TV screenwriter who created great episodes of Buffy the Vampire Slayer, had some level of fame previous to this week. But her fame grew to much greater magnitudes on Tuesday when she created a Pringle sculpture* that went viral. You can spend years as an accomplished writer with little public notice. But post a photo of your food sculpture on social media and–BOOM–you’re now the real deal. Regarding today’s fame factory: on the one hand, we are clearly doomed. On the other, that’s a pretty impressive Pringle sculpture. But even as we double-dip a chip into salsa, we present you with where global talent is flowing to, what China is investing in and who the big drinkers are. It’s this week’s International Need to Know, giving Buffy-like kicks to global ignorance wherever we find it.

Without further ado, here’s what you need to know.

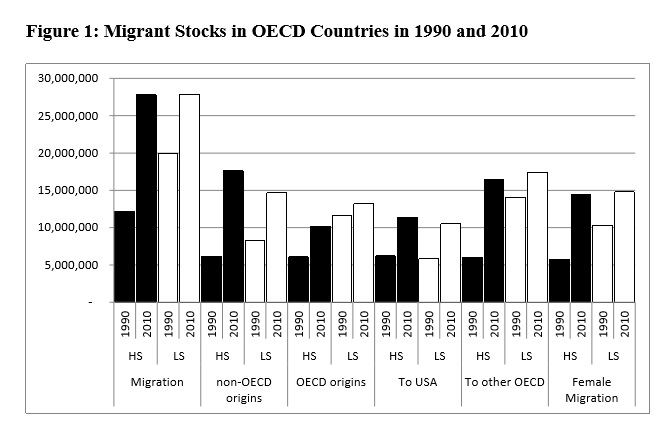

A new paper on global talent flows reveals some interesting trends and data, some of which upends our commonly held assumptions. For example, the authors write, “Approximately 3 percent of the world’s population lives in a country different from that of their birth and, despite the impression sometimes presented in the media, this share has been roughly constant since 1960.” Okay, so maybe we should all calm down about immigration. The authors dig down deeper and examine where high skilled talent is moving to. Unsurprisingly, there has been a large increase in the flow of high skilled talent into highly industrialized, high tech economies. In fact, since 1990, there has been a 130 percent increase of highly skilled migrants into OECD (Organization for Economic Cooperation and Development) countries. The growth rate for low skilled migrants was only 40 percent. But, perhaps most startling and consequential for our world is that four countries–the United States, the United Kingdom, Canada and Australia—”constitute the destination for nearly 70 percent of high-skilled migrants (to the OECD) in 2010.” Like a high school dance, all the smart people are gathering together in a corner of the gym forming cliques. Global movement is important for the world–we’ll have more next week on how our world moves, or as may be the case, doesn’t.

China Investment

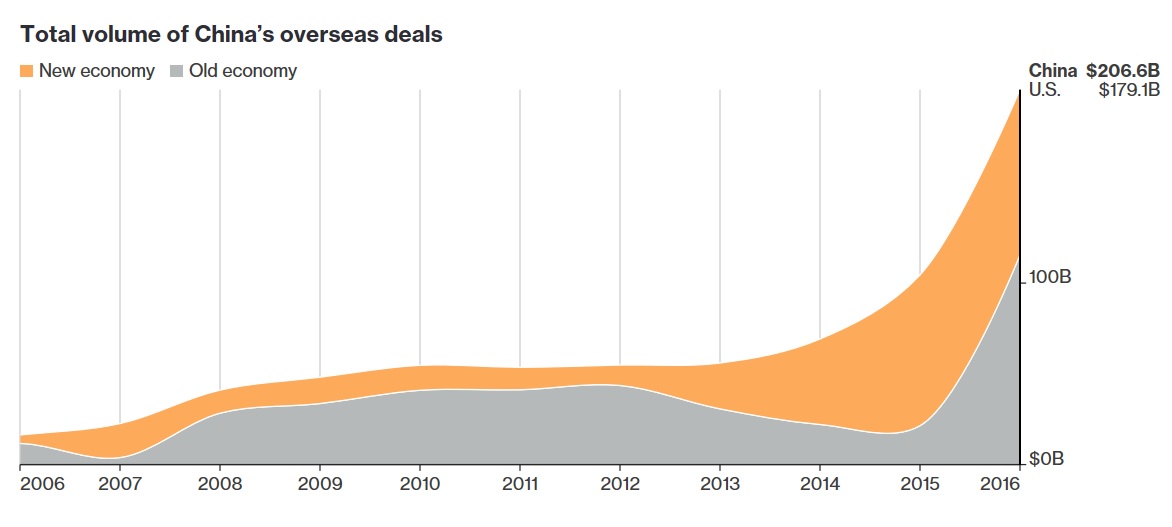

People are mobile and so is capital. Last week we talked about where Chinese are moving to, this week we follow the money. For the first time, according to Bloomberg, “Chinese companies are buying up overseas assets at a faster pace than U.S. buyers.” As China’s appetite for overseas investment continues to grow, its taste in investments has changed. A few years ago, many of China’s investments were in the energy sector but today China is gobbling up technology, consumer and brand companies. As you see in the chart below, new economy deals are far outstripping old economy. According to Bloomberg, there is also a shift from state-owned companies buying assets to private entrepreneurs buying brand companies and “marquee assets like Italian football teams, American film studios and French fashion houses.” (a merger of a football team, film studio and French fashion house could lead to the most beautiful sports movie of all time). Of course, sometimes it is difficult to distinguish between private and public companies in China. Nonetheless, we are curious to see how these investments pan out and whether there is a difference in the ROI for state-owned investments and the apparently private investments.

Where the World Drinks

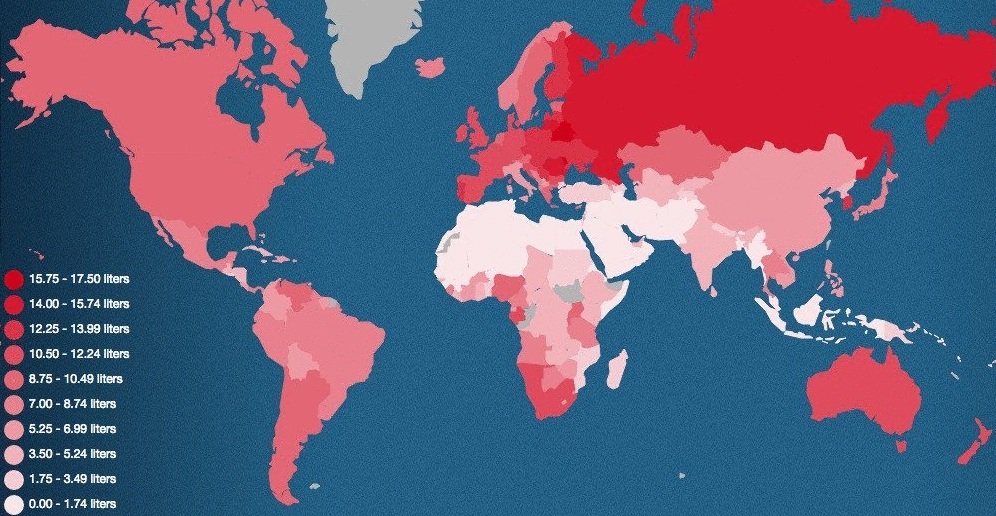

Over a decade ago I was spending some time in Russia for work, particularly the Russian Far East. One Sunday morning I bundled myself up (it was winter and much colder than my home climate) and went for a walk. I came across a number of men–not vagrants or homeless or anything, just your average guys–casually drinking vodka. On a Sunday morning. No Johnny Cash Sunday Morning Coming Down song to validate the action. So I am not surprised by the map below from Weird History showing Russia consuming more alcohol than other parts of the world. In fact, if I was making bar bets, I believe I would have gotten most of these drinking statistics correct, which says something about both me and the drinking habits of our globe.

*All bow down to the great Espenson Pringle Sculpture:

Lazy Men, Where Chinese are Moving to and Energy Complications

The Interurban bike trail is located near the worldwide INTN Headquarters and the other evening while riding on it, we saw a man with a chain saw leap from one roof to another leading us to hope that “chain saw man” replaces the scary clown meme. As we continued our ride, we started to count the number of jobs that would no longer be around in five, ten, twenty years. We saw a UPS driver, taxi cab and soccer coach among many others. While counting we came to a stoplight and gazed into the upper reaches of Shoreline City Hall where we saw two lonely flip charts in a window awaiting planning of our future. We took a photo hoping to catch this symbolic moment of our uncertain times, but alas our photography skills were not up to the task. Fortunately, however, we are up to lamenting the lost generation of men, hunting down where the Chinese are moving to and contemplating the complications of energy. It’s this week’s International Need to Know, scratching “x’s” on our walls ’til election day while sneaking out important international information to the world.

Men, We Have a Problem

It is somewhat fairly well known that men’s participation in the U.S. labor force has been declining. There has even been speculation that video games and the Internet have made it easier and more fun for men to be unemployed than making a wage. Perhaps less well known is that the phenomenon of fewer men working is a problem throughout the developed world. The Federal Reserve Bank of St. Louis recently compared labor rate participation rates in seven industrialized countries with the United States going back to 1970. They found that “the labor force participation rates for prime working-age men have been falling in all of the countries.” Interestingly, in recent years Sweden, which also saw its male labor participation rates fall since 1970, has seen an increase. Why? We don’t know. But the general trend for three decades has been for men to work less. Coupled with the fact that men are less likely to go to college than women, the data on we men is not good. This phenomenon may help explain a variety of political and economic distress signals around the world. What to do about it, other than shipping our men off to Sweden (we suspect lutefisk and the opening of an ABBA Museum plays a role), we are uncertain.

Where Chinese are Moving to

I am fortunate to work with a number of Chinese investors in my business. Increasingly they not only want to invest here in the United States but also to move here. When I talk with colleagues who are also working with China, they are experiencing the same thing. Two years ago, Barclays did a survey that found that “47 percent of Chinese millionaires plan to emigrate.” I have not found an update to that study but I have no anecdotal evidence to point to an abatement of this desire. So where are Chinese moving to? The Migrant Policy Institute (they move their headquarters every year to a different country) tells us that the United States is the largest destination for Chinese migrants with just over 2 million Chinese.* South Korea is second with 751,000, followed by Canada, Japan, Singapore and Australia. What does wealthy Chinese wanting to move elsewhere say about China’s economy and political system? What does it mean for the future of China? We know one thing: for the recipient countries, history says they will benefit tremendously–just don’t tell the anti-immigration forces.

*We are excluding Hong Kong from this analysis

Energizing the World

We have detailed the ongoing solar revolution in this space, both in terms of the exponential growth in generation and new breakthroughs in storage. But we’ve often couched these breakthroughs in terms of transportation. Of course, the world uses energy for more than getting from point A to point B while making a nice stopover in Point C’s beaches and resorts. No, we use energy for all types of things, including industry, buildings and agriculture. This leads to more emissions into the atmosphere. Below you’ll see a breakdown of these emissions since 1970. Our use of energy has increased tremendously across all these sectors, including in transportation since the era of the wide necktie. The next chart shows that high income countries emissions have actually declined. And just for kicks, the last chart shows China’s outsized use of cement in the world, which is a very energy intensive industry. Evolving the world’s use of energy and emissions will be complicated, but doable, and we continue to maintain will come sooner than people think.

Europeans and Diversity, Fewer Japanese & More Robots, and What the World Reads

Last Friday we saw the great Dr. John perform in Tacoma. Tacoma is not far from Seattle as the seagull flies, but with horrible traffic it was a multi-hour drive and it was also a long ways from Seattle culturally. Seattle, like many cities nowadays, prides itself on its sophistication and worldliness. And yet at Peterson’s Brothers in the Hilltop neighborhood where we ate before the concert, we experienced more diversity than in any Seattle joint we’ve been to. We saw more racial and ethnic diversity, age diversity, socio-economic and many other types of diversity all wrapped around a good meal and a beer. Tacoma felt more worldly and sophisticated than the wonder bars of it’s northern uppity cousin. Such a Night. But even as we boogied with the Good Doctor and enjoyed the vibes of Tacoma, we also examined Europeans’ views on diversity, robotic farms in Japan and what are the most popular books in the world. It’s this week’s International Need to Know, providing you what you need to understand around the world sans any locker room talk.

Without further ado, here’s what you need to know.

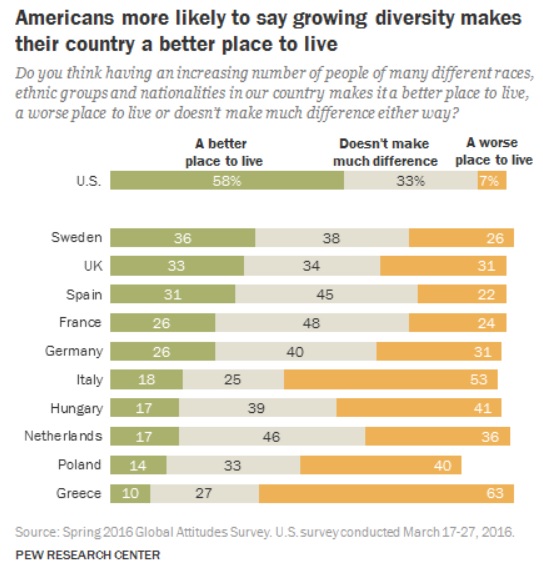

Europeans and Diversity

Immigrants are a hot button issue in many places nowadays, including and especially in Europe, which currently has more than its fair share of overly warm knobs. A new Pew Research Center Survey shows that at least in some European countries, non-coincidentally those much affected by the refugee crisis, diversity is not smiled upon. Greece has the least favorable view of diversity with 61% saying it makes a country “a worse place to live.” Italy is not so high on the idea either with 53% unfavorable to diversity. Sweden has the most favorable view of the concept with 36% saying diversity “makes for a better place to live.” Interestingly, the U.S. has far more favorable views of diversity than any of these European countries with 56% of the country stating it “makes for a better place to live.” With a host of upcoming elections in Europe, rhetoric and campaigns will undoubtedly reflect the moods found in these polls.

Fewer Japanese, More Robots

As we’ve noted, there are fewer Japanese today than there were yesterday and there will be fewer yet tomorrow. Japan’s aging population and low fertility rate is emptying the country with the population decreasing by one million people since 2015. With fewer workers, Japan is addressing the situation by turning to robots so we read with interest this Guardian article about a Japanese firm opening the first robot run farm. The Japanese agricultural company, Spread, says that in mid-2017 it will open an indoor farm in which industrial robots will carry out all tasks except for the planting of seeds, Galatians might be surprised that robots will reap what we sow. The company says within five years they will boost production to half a million lettuces. That’s a lot of salad, both for Japanese consumers and for the company. Currently the company supplies 2,100 supermarkets in Japan. The number of farmers in Japan has declined from 2.2 million a decade ago to 1.7 million today. With a smaller population and more people living in the city, you can bet that number will decrease more over the next ten years and the number of robots in Japan will increase. When keeping an eye out for the rise of robots, look to Japan. Its demographics and culture may make it the first of our Asimovian worlds.

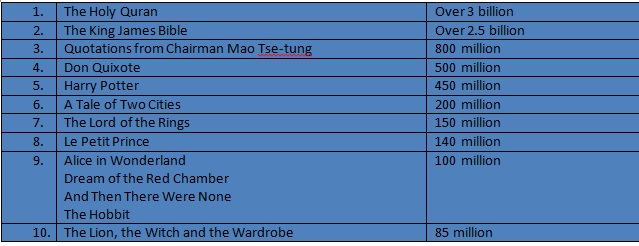

What the World Reads

We here at International Need to Know like to read. At any given time we are usually reading at least one novel and one nonfiction book (currently The Singapore Wink by Ross Thomas and The Future of Violence by Benjamin Wittes, plus the new Bruce Springsteen memoir). The other night with Kindle in hand, we wondered what are the bestselling books in the world and what do those books’ popularity say about the world. Wonder no longer, courtesy of the U.K.’s lovereading.com website, here’s the list. We were surprised by a number of the books on the list, including Don Quixote. We have some disagreement about a few of the others’ popularity but that would be tilting at windmills. Draw your own conclusions on the meaning of these books popularity and what it says about our literate world.

Rise of the Global Middle Class, Creative Destruction and Immigrants to the Rescue

In the space of less than 24 hours, we talked with both billionaire Paul Allen and rock icon Bruce Springsteen. We thanked them both for their contributions to our life and to society. A day or so later we talked with a middle-aged woman named Yvonne who has settled in on a corner two blocks from the worldwide INTN headquarters. Her new lodgings are modest with only a large umbrella and some plastic bags to protect her from the elements. We expressed our concern for her and asked if there was anything we could do to help. In perfect Queen’s English and diction out of a PBS Masterpiece Theater show (which threw us for a loop and upended our stereotypes), she informed us her house is up the street but she had settled here because of the people who were encamped at her house waiting to travel to their “destination.” We did not know what to do with this information nor how to help this unfortunate soul. Her problems and challenges are well beyond our expertise and experience. If you have ideas of how we can help, we welcome them. Perhaps she will not end up like Paul Allen and Bruce Springsteen but we would dearly like to get her to somewhere better than her current physical and psychological setting. But billionaires, rock stars and Yvonne did not keep us from applauding the rise of the global middle class, worrying about the lack of new companies and nodding at the role immigrants play in entrepreneurship. It’s this week’s International Need to Know, taking us on an international journey to enlightened destinations.

Without further ado, here’s what you need to know.

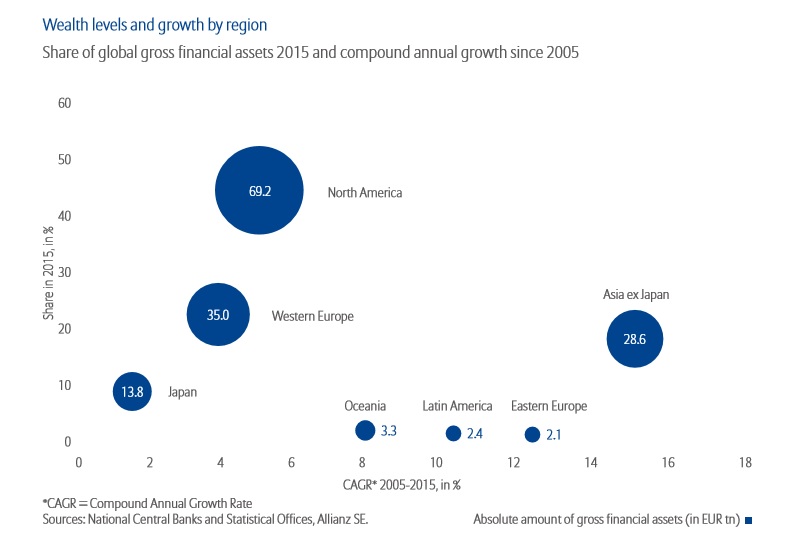

Rise of the Global Middle Class

Even during the height of the global financial crisis, we traveled lots internationally for work. We were struck that planes were full and there were no tables available at the restaurants in the cities we traveled to. Lots of people were and are hurting but large numbers have entered the middle class in recent years and you see them in museums, tourist sites and elsewhere around the world. It is a sign of global progress, even if it has made touring and traveling more challenging. Allianz’s latest Global Wealth Report tells us that “…in recent years, more and more people, almost 600 million in total, have achieved promotion to the middle wealth class.” Of the 50 countries Allianz monitors in North America, Europe, Asia and Latin America, the middle wealth class share of the overall population climbed from 10% to about 20%. Further, “the proportion of global assets held by this wealth class has also grown significantly, rising to 18% at the end of 2015, almost three times the amount seen at the start of the millennium. So the global middle class has not only been getting bigger in terms of the number of people who belong to it, it has also been getting increasingly richer.” As you can see in Allianz’s bubble chart below, Asia (not including Japan) has been the fastest growing region and responsible for much of the increase in the global middle class. In fact, it is rapidly catching up to Europe in terms of financial assets. One possible reason for dissatisfaction among the masses in Europe and America is that even though things are slowly getting better, in comparison to other regions of the world, we feel we are falling behind. It’s an Einsteinian economic relativity problem. We talked of fear last week. Be forewarned! We will dive further into this data in the future with that powerful, incentivizing, sometimes damaging emotion on our mind.

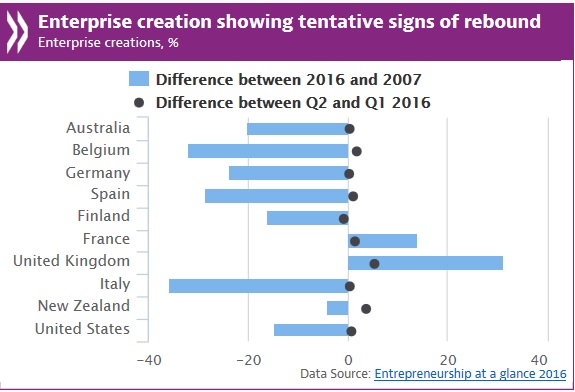

Creative Destruction?

We all fetishize the entrepreneur and the creation of new businesses. And yet, the West has sucked (to use a high falutin economic term) at enterprise creation since the Great Recession. New business creation since 2007 in both the United States and Europe has been like a Japanese child birth ward–not nearly enough babies to fill the place. In fact, the U.S., allegedly the home of the brave and the land of the free, has been particularly bad at new business creation. But, the OECD’s Entrepreneurship at a Glance report gives some measure of hope. So far 2016 is seeing an increase in enterprise creation across a number of OECD countries. This is happening especially in Europe: “The report shows that post-crisis growth in Europe has been more dependent on small and medium-sized enterprises (SMEs) as drivers of economic growth than in the United States.” There is, however, a long ways to go to get to where we were pre-financial crisis. As the OECD notes, “Trend start-ups remain below pre-crisis rates in most OECD economies, although in Canada, France, the Netherlands, Norway, Sweden and the United Kingdom rates were higher at the end of 2015 and beginning of 2016 than before the crisis.” One of the big policy debates we should be having is how policy increasingly places small companies at a disadvantage to big business. I have a feeling, however, through November we will talk of other things instead.

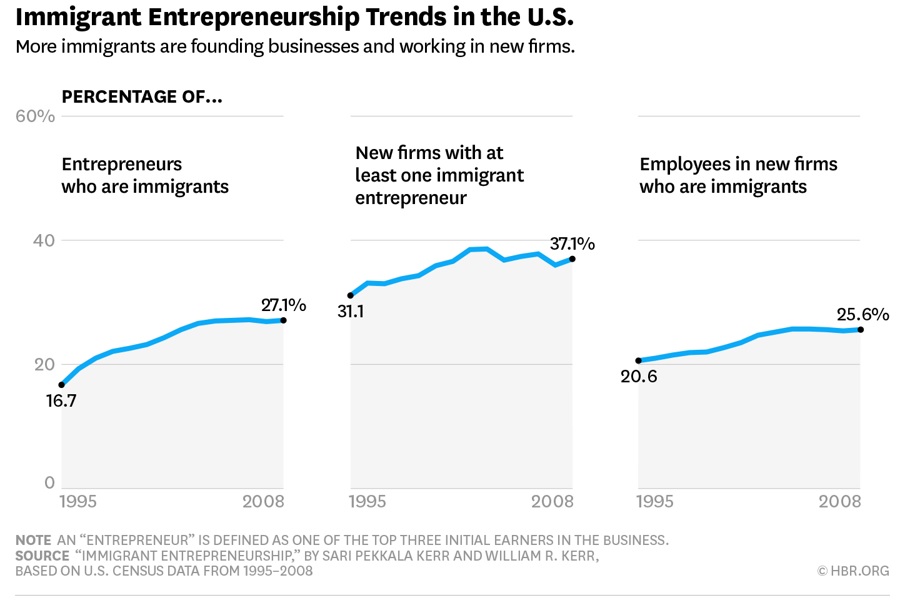

Immigrants to the Rescue

When I was in Silicon Valley a few years ago, the local boosters noted that 50% of the CEOs in the valley were foreign born. It’s both a startling and unsurprising number at the same time. More than any other attribute, the relative success in absorbing immigrants distinguishes the U.S. from the rest of the world. The Harvard Business Review (HBR) provides more data on the importance of immigrants to entrepreneurship and new business creation. According to HBR, “Immigrants constitute 15% of the general U.S. workforce, but they account for around a quarter of U.S. entrepreneurs.” The research also points out that immigrants account for about 25% of U.S. inventors. In fact, nearly 40% of new firms have at least one immigrant as one of its founders. Immigrants are one salve for the lack of new business creation in recent years we discuss above. Changes in policy are needed to make up the rest.

Europe’s Electric Slide, Top Airports and Where Women Rule

With the political landscape looking Dune-like to many and as we here at INTN increasingly worry that we will not witness the Seattle Mariners in the World Series in our lifetime (a certain shortstop and first baseman are on our list–that list is long and extensive with not nearly enough repercussions), it is always helpful to step back and get a little perspective about our world. Our species has been around for but a blink of an eye as illustrated nicely by the blogger, Jason Kottke, who publicized the concept of The Great Span. This is the idea that it is easy to connect two historical events or figures across large swathes of history, illustrating just how short human history is. For example, “two empires [Roman & Ottoman] spanned the entire gap from Jesus to Babe Ruth. Three civil war widows were alive in the 2000s. President John Tyler’s grandson is still alive.” So worry not too much about current events, today is but a flash in the expanse of time and space. Nonetheless, the brevity of human existence leads us to delve into how to power electric vehicles in Europe, discover where the largest airports are and gape in astonishment at where women executives rule. It’s this week’s International Need to Know, remembering that Vin Scully was announcing when Connie Mack was still manager, even as we pass on international wisdom in nanoseconds (relatively speaking) of time.

Without further ado, here’s what you need to know.

The Electric Slide

For ten years, from 1989 to 1999, the Electric Slide was the number one dance in the world. If more evidence is needed for both the agony and the ecstasy of the 90s, you will not get it here. We dance our own electric slide examining a new report from the European Environment Agency (EEA) about the rise of electric cars and the new infrastructure required to support them. The EEA examines two scenarios for the year 2050, one in which half of cars in the EU are electric and one in which 80% are electric. Either scenario should be good news, right? But the agency rightly points out that an increase in the use of electric cars does not help the environment unless that electricity is generated by renewable resources. Under Europe’s current energy infrastructure, there would be a net reduction of CO2 emissions (see chart below) and for some other pollutants. But, because cars emit very little sulphur dioxide, there would actually be a net increase in 2050 of this pollutant unless the electricity for the vehicles is not generated by fossil fuels. Fortunately, as we’ve pointed out previously, thanks to advances in solar power generation and storage, we are likely to no longer need fossil fuels to a large degree long before 2050 (probably by 2030). It’s electric, boogie woogie woogie.

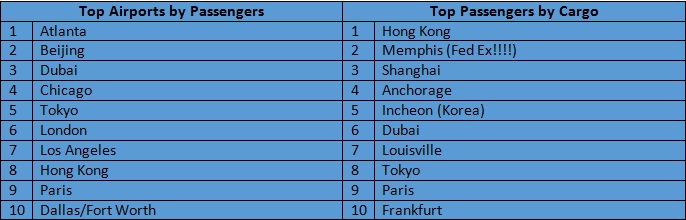

Come Fly With Me

There’s a reason why Boeing and Airbus eye China and the rest of the Asia Pacific region like a seven-footer seated in coach greedily eyes first class. Thar’s gold in them there skies. Airports Council International released their latest data on who and what is flying from where. The Asia Pacific region continues to be the largest air passenger market with 2.46 billion passengers, an 8.6% increase over the previous year. But as fast as the Asia Pacific traveling market is growing, the Middle East is actually the fastest growing region with a 9.6% increase (though far few passengers overall–334 million). Of course, the Middle East market is benefitting from Emirates Airlines efforts to successfully make Dubai an international airport hub–Dubai is now the second-largest international airport as measured by international passenger traffic. One worrisome sign in the data is the relatively modest growth in air cargo (2.6%), another sign of the slowdown in international trade we noted earlier this year.

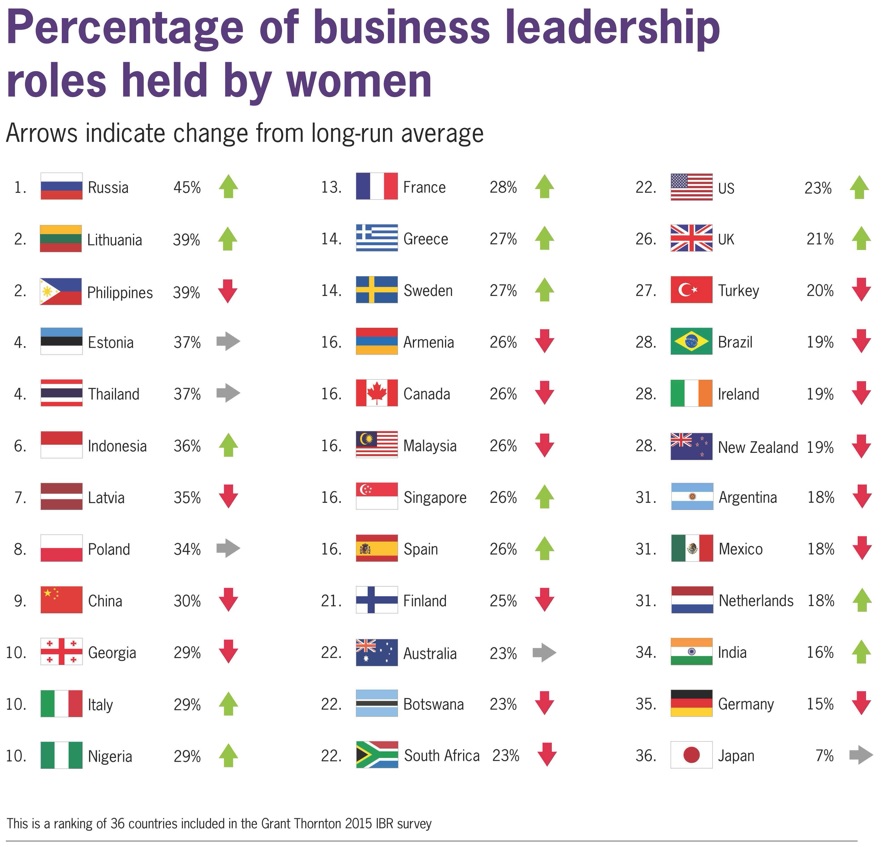

Where the Women Executives are

The United States may, or may not, elect a woman president this year. If we do, we’d be catching up to other countries, many of which have long ago elected female leaders. The United States is not only behind other parts of the world in electing a woman president but is also lagging behind some countries on the number of women business executives. You may be surprised to learn that Russia leads the world in the percentage of women in senior roles in business, coming in at 45 percent. In fact, Eastern Europe as a whole does well with 35% of senior roles held by women. In the United States, 23% of women hold senior roles in business. China is at 30%. Maybe in the future a crazy, loud-mouthed businesswoman can run for president.

Refugees, Quantum Computers and China’s Box Office

We were knee deep in research for a client this week and chuckling at the fact that the most clicked link this year in one of our posts was for the inflatable Irish pub when red alerts started flashing here at the INTN worldwide headquarters about the great, sudden and unexpectedBrangelexit. We, of course, dropped everything at the news and even wondered whether we would need to cancel this week’s edition of INTN. But calmer heads prevailed allowing us to still dive into the state of the world refugee problem, examine one possible savior of Moore’s Law and speculate about China’s box office. It’s this week’s International Need to Know, paying no attention to the rumor that Angelina Jolie left Brad Pitt for Mr. Brexit, former British Prime Minister David Cameron while we bring you the world’s laundry, dirty and clean, but certainly folded and ironed for your reading pleasure.

Without further ado, here’s what you need to know.

Refugees from Reason

One of the more tragic, complicated and perhaps misunderstood stories of the last few years has been that of refugees. The huge increase of refugees has stressed national and international political systems. Which countries have taken in the most refugees? Germany takes the top spot. Perhaps consequently, Angela Merkel’s party did the worst it’s ever done in the Berlin state elections earlier this week. Sweden has taken in the most refugees per a percentage of its population. Perhaps also consequently, the ruling party is at its lowest rating in the history of Swedish polls. This is another example of a transnational challenge taking place at a time when people, whether here in the United States or in other countries, are losing their faith in existing institutions. We discussed the loss of confidence in institutions during the Brexit vote, and the subject is likely to come up often in the future. This all takes place even as in many ways the world is more peaceful and prosperous than ever. But perhaps people anticipate a future with different challenges that will require different structures. Or maybe they’re just scared. We have theories about fear and will delve into the emotion and its affect on the world as we go forward, but one of the grand challenges of our time is to refine current and perhaps develop new global structures that people will trust.

.jpg)

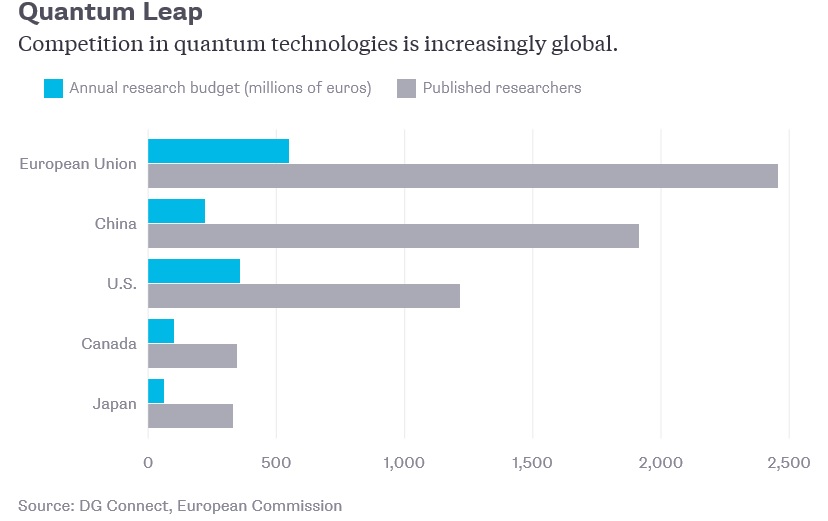

Moore’s Law Slowing, Quantum to the Rescue?

It’s not been talked about loudly but Moore’s Law is slowing. Instead of computer chips doubling in transistors every two years, it has slowed down to every two and a half years. Intel admittedearlier this year this trend may continue and worsen. There are a number of mid-term solutions in the works to keep Mr. Moore and his law happily churning away but we stop for a moment to consider the long-term solution, the paradigm shifting possibility of quantum computers. Such machine beasts could ” take advantage of odd subatomic interactions to solve certain problems far faster than a conventional machine could.” So who is working on this technology? Lots of people. But Europe leads the way. The European Union outspends in research and funding and has more published research on quantum computers than both the U.S. and China. Moore’s Law may be slowing down but the globalization of innovation is not.

Bombing China Box Office

In our continuing quest to figure out what is really going on in China we turn to the movies. Specifically the box office numbers for China. In either a worrisome sign for China’s economy or for the state of the movie business nowadays, we see that box office receipts in China are down 18% percent year over year. Some of the decrease apparently is due to online ticket vendors no longer providing discounts in an attempt to gain market share for their businesses. But even so, that’s a huge drop and can’t be blamed only on horrible Hollywood blockbusters since the government limits the number of foreign films shown in China. No, more than likely this is another sign the Chinese economy is not as robust as portrayed in official economic numbers, combined with unsuccessful movies and the rise of other entertainment for our eyeballs and wallets. But what the heck, let’s blame the lame Suicide Squad anyway.

More Evidence of Peak Oil Usage, Who is Retiring and what is the most popular liquor

Humans are a remarkable species. We have transformed from simple cave painters to creating masterpieces on the ceiling of the Sistine Chapel. We have discovered prime numbers, built machines that can fly, developed self-driving cars and created a computer network through which all the world can communicate. It’s a remarkable development for any universe. But perhaps the species has peaked with the invention of the inflatable Irish pub. Yes, two Irish immigrants now living in Boston (see, immigration is good for America), have developed what they call the Paddy Wagon Inflatable Pub. So, even as we pour a Guinness and order one of these pubs online, we find more evidence for the coming of peak oil usage, discover where young people are retiring (not just in Portland, Oregon) and most appropriately find out what the most popular liquor in the world is. It’s this week’s International Need to Know, trying not to grow faint at the American presidential race as we deliver healthy and sane doses of the world to your inbox.

Without further ado, here’s what you need to know.

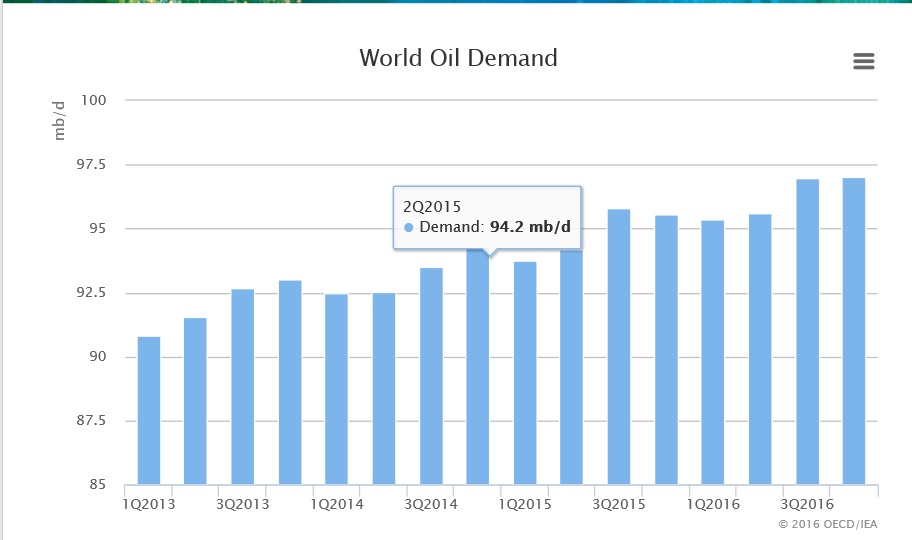

More on Peak Oil Usage

Keen INTN readers will recall that earlier this year we speculated on peak oil usage coming to a world near you and noted that while oil prices may rise in the mid-term, in the long term they would stay low as other energy sources increasingly power the world. This week brought two bits of news increasing the likelihood of this scenario. First, the International Energy Agency (IEA) reported that oil consumption growth is below their projections, growing at only 1.3 thousand barrels per day. Yes, oil consumption continues to grow worldwide but at a slower rate than previously and below expected growth rates. The IEA believes slowdowns in China and India is one reason for the slower growth in world oil consumption. If so, perhaps this is more evidence that China is not growing as fast as advertised. But slow economic growth leading to slower growth in oil consumption is a bridge, perhaps over troubled economic waters, to other future factors that will slow the growth in oil and eventually lead to decreasing consumption. General Motors announced this week that they are releasing a Tesla before Tesla. Their new Chevy Bolt that will be released later this year will have a range of 238 miles, slightly more than Tesla’s Model 3 coming next year. Analysts believe the 200-mile range is the tipping point for making electric cars viable. The Bolt will cost a somewhat reasonable $30,000 (after a $7,500 federal rebate). In addition, new non-electric cars have much better gas mileage than their predecessors. Our new Subaru gets about 20% better gas mileage than the 2007 Subaru we owned previously (by quota, 47% of all Seattle citizens must own a Subaru). Gas mileage is mandated in the U.S. to become even more fuel efficient in the future. More people around the world will be driving (though the advent of self-driving cars will change that) but the amount of oil used to power those cars will decrease. Peak oil usage is not here yet but it’s coming sooner than people realize with all the benefits and economic disruption that will entail.

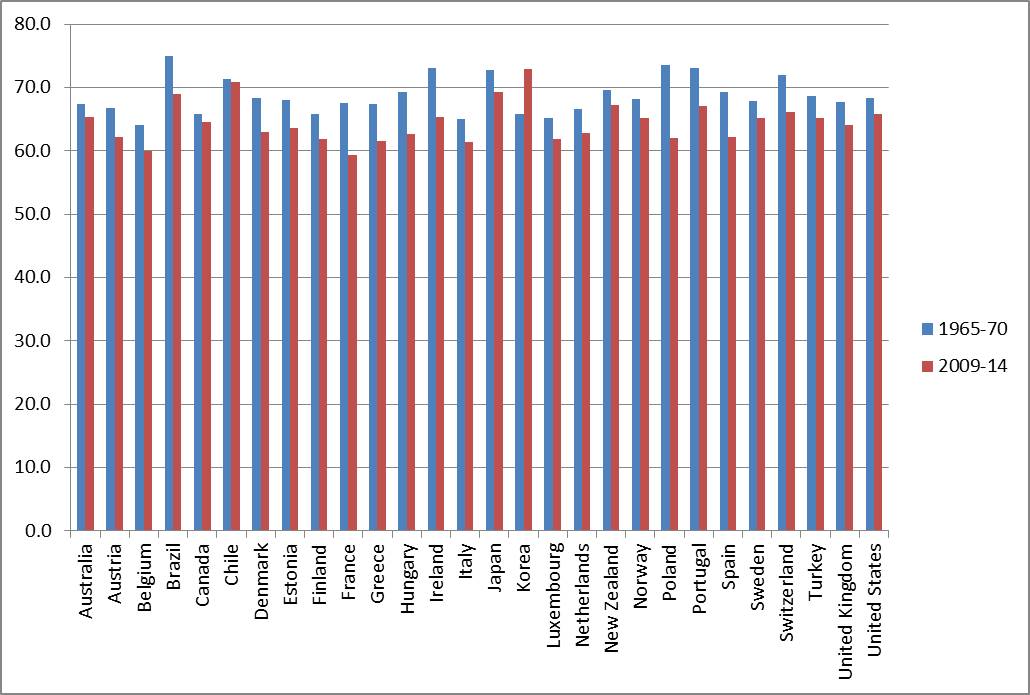

Living Longer, Retiring Earlier

Life spans are increasing all over the world as health and nutrition improves. Perhaps surprisingly, people are also retiring at a younger age. The OECD (Organization for Economic Cooperation and Development) informs us that, “In almost all OECD countries, the effective retirement age has declined substantially since 1970.” The OECD defines “effective retirement age” as “the average age of exit from the labour force during a 5-year period.” In most OECD countries, the effective retirement age is now below the age when citizens receive retirement benefits (what the OECD terms the “normal” retirement age). Japan and Korea are the exceptions where men on average retire at age 70 despite the “normal” retirement age being age 60. Perhaps not surprisingly given challenges in OECD economies, the trend of retiring at a younger age has abated or in some cases reversed in the last decade. But, even so, people still retire at a younger age than in 1970. Below is a list of retirement age changes for men for a variety of countries in 1970 compared with today. Women on average retire two years younger than men.

The Most Popular Liquor in the World

Like most who have traveled overseas often for work, we have sampled a wide range of tasty and on occasion dubious liquors. In Korea, of course, we drank soju, an alcohol made out of rice, barley and increasingly today from potatoes and sweet potatoes. Koreans drink soju in large quantities but we were surprised to learn this week that it is the most consumed liquor in the world (and even more surprised to learn of this through the sports and pop culture website, The Ringer). Much as we have been impressed by Koreans drinking ability, obviously this is an indication that soju is popular throughout Asia (and now there is a big push of it into America). This is perhaps appropriate since soju’s origins date to the Mongol invasion of Korea in the 1300s. History, as always, circles around itself (or stumbles drunkenly as may be the case). According to IWSR (which tracks such things), soju dominates the top spirits sold around the world, claiming three of the top ten spots. In second is India’s Allied Blender & Distiller’s whiskey, Officer’s Choice. Smirnoff’s takes fifth place. The top ten below is full of surprises, at least for this internationally traveling imbiber.

Asia’s Rise, More on Chinese SOE’s and Decreasing Chinese Productivity

Here at INTN worldwide headquarters, we romanticize beginnings. The evolution of jazz in early 20th century New Orleans is an almost mythical time for us, as are the Sun Studio recordings of the early 1950s. So it is not a surprise that we are a big fan of The Get Down, the new Netflix show that fancifully tells the story of the beginnings of hip hop in 1970s NYC. One of our fondest memories as a youngster is visiting our grandparents on the lower eastside of Manhattan and being allowed at the end of the day to pull the security gate down on their children’s shoe store. The five boroughs back then also had a mythical feel, full of noise, grime, crime, fantastical creatures and above all, creativity. New York is safer and cleaner nowadays but not nearly as interesting. Even as we speculate that somewhere, someplace a new musical or cultural moment is being born today (probably either in an impoverished city overseas or in a down and out suburb of America) we ponder on Asia’s recent rise out of poverty, gaze again at China’s state owned enterprises and at the same time worry about Chinese productivity. It’s this week’s International Need to Know, using our digital crayon to find the get down on international happenings.

Without further ado, here’s what you need to know.

Asia’s Rise Out of Poverty…

Via Ian Bremmer, we recently saw the graph below from the Harvard Business Review(HBR) showing the amazing income gains of the Asian middle class. As Branko Milonovic of HBR notes, “The ‘winners’ were the middle and upper classes of the relatively poor Asian countries and the global top 1%.” But the relative “losers”, at least for the years 1998-2011, were lower and middle income percentiles in the already rich countries. The researchers also note that, “It’s also the first time that global inequality has declined in the past two hundred years.” They calculate that the global Gini number (a measure of inequality—in our estimation a very crude measure) decreased to 64 from 69 (but not 867-5309–wait, Gini, not Jenny). This is an underreported phenomenon: income inequality has gone up within many countries but for the world as a whole, income inequality is down. But, the Harvard Business Review takes this one step further, believing increases in Asian incomes must occur at the expense of Western incomes: “If we then visualize the world over the next 30-50 years, in which other, even poorer countries, become the ‘new Chinas,’ the stagnation of middle-class incomes in the rich countries may continue.” But there are many roads, highways and even back alleys to prosperity. Most need not be lined with western stagnation. Today’s future has very different starting conditions than the last two decades and so the path forward will lead in a different direction. As the investment advisors say, even while selling swampland in Florida (or southern China), past performance is not an indicator of future results.

More on China’s SOE’s

No sooner do we write last week that China’s corporate debt is in many ways government debt because state owned enterprises account for more than 50% of such liabilities, than Fortunemagazine comes out with their list of the 500 largest companies (ranked by revenue) and lo and behold it trumpets that China now has more than 100 companies on the list. Three of these are in the top ten and every single one of them is a SOE—China National Petroleum, State Grid and Sinopec Group. I expect this top ten list to be volatile, partly because the Fortune 500 is volatile(the Global 500 likely even more so) and partly because China is changing so quickly that so too will its companies on this list. We live in a Ferris Bueller world, if you don’t stop and look around every once in a while, you’ll miss it. Many of the companies on this list will disappear soon like Cameron’s father’s Ferrari.

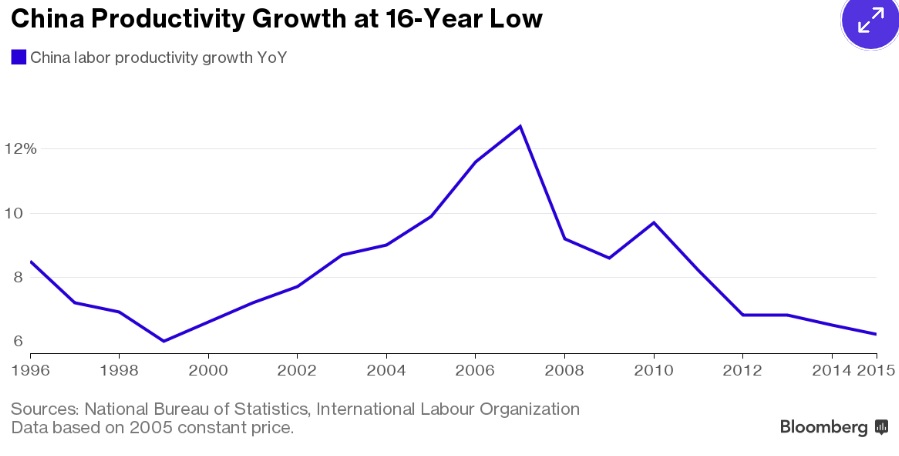

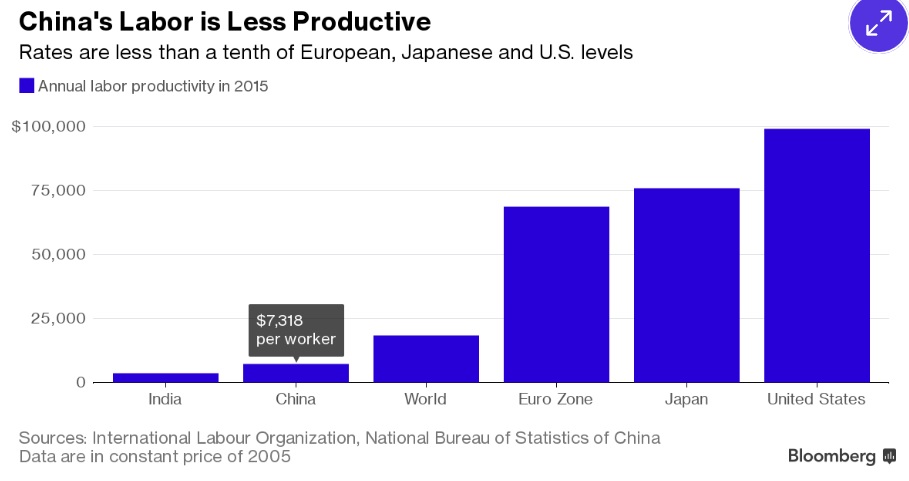

The World is Doing Nothing

A number of months ago we noted the worldwide decrease in productivity. The chart we posted showed slowdowns in productivity around the world but did not include China. However, China’s productivity growth, while still above Europe’s, Japan’s, Korea’s and the U.S., is also steadily decreasing, now down to 6.6%. It peaked at 13% growth in 2007 and has gone down ever since. Are Chinese workers just as susceptible to cat videos on the Internet as the rest of us? As we noted in the previous post, the worldwide decrease in productivity is worrisome for the prospects of future GDP growth. GDP can only grow through increased productivity or working age population growth (the latter is decreasing in most countries save Africa and India). More worrisome for China, though their productivity and economic growth has been extraordinary the last 25 years, they have still not caught up to developed countries (see second chart below) or even to the world average. Each Chinese worker is producing far less than a Japanese, European or American, even as the costs of Chinese labor rises, leading to more automation. As we saw above, the Harvard Business Review is worried about Asian workers’ gains causing western income stagnation. The story is likely to be more complicated than that. As always, we await the next chapter eagerly but also with a bit of trepidation.